Paga Nigeria

Terms of Service

Please read the following Terms of Service carefully. By using Paga or this website, you are agreeing to these Terms of Service.

Customer Terms of Use of Paga

Paga is provided by Pagatech Limited ("Pagatech" or "We"), a private limited liability company licenced by the Central Bank of Nigeria to provide electronic payment systems services.

You are required to read and understand these terms, as they are a binding agreement between you and Pagatech. Customers who are under eighteen (18) years of age should review these Terms of Use with a parent or guardian.By registering for a Paga Account or Wallet or using any of the services provided on this website, you agree to comply with and to be bound by these Terms of Use, including the Privacy Policy and all rules, guidelines, policies, terms, and conditions applicable to such service, and they shall be deemed to be incorporated into this Terms of Use and shall be considered as part and parcel of this Terms of Use.

Definition

The following definitions relate to these Terms of Use:

1.1. "Account" or "Wallet" is an electronic stored value account on Paga created for use by the customer or Agent. Credits, debits, and charges are applied to this Account. The Account is primarily accessed through your mobile phone, the Paga online systems, and mobile applications.

1.2. "Agent" refers to any party or device, including authorized Paga Agents, Merchants, ATMs, connected kiosks and bank tellers that facilitate Paga transactions on behalf of customers.

1.3. "ATM" means automated teller machine.

1.4. "BVN" means Biometric Verification Number used by the banking industry in Nigeria and issued by a CBN-approved financial institution.

1.5. "CBN" means the Central Bank of Nigeria

1.6. "Content" means all information whether textual, visual, audio or otherwise, appearing on or available through the services.

1.7. "Credit" means the movement of funds into an Account or Wallet.

1.8. "Debit" means the movement of funds out of an Account or Wallet.

1.9. "IVR" means Interactive Voice Response system, the automated phone line that allows a computer to recognize voice and keypad inputs.

1.10. "Level 1 customer" means a new customer who provides the minimum requirement listed in [4.9] below and as defined in the CBN three-tier Know Your Customer (KYC) requirements, either in a self sign-up process or to a Paga agent or authorized administrative centre.

1.11. "Level 2 customer" means a Paga user who has submitted his phone number, full name, full address and a copy of a verifiable ID card or phone number and BVN as defined in the CBN three-tier KYC requirements either in a self-sign-up process or to a Paga agent or authorized administrative centre.

1.12. "Level 3 customer" means a Paga user who has linked his Paga Account with his BVN or has linked his Paga Account to his bank account with one of the banking institutions licensed by the CBN and has provided all required KYC information as defined in the CBN three tier KYC requirements, either in a self sign-up process or to a Paga agent or authorized administrative centre.

1.13. "Linked Bank Account/Card" means the bank account or bank debit or credit card that you have linked to your Paga Account. This allows you to carry out transactions using funds from your bank account or bank card instead of using your Paga Account balance.

1.14. "Merchant" means any person or entity who offers and or accepts payment for goods or services using Paga.

1.15. "Mobile Payments" means the service or process that allows customers to make and receive a variety of payments using their mobile phone, among other channels. This service is available as part of Paga.

1.16. "Mobile phone" means a GSM or CDMA device, which can make and receive telephone calls and send and receive SMS, among other communication options.

1.17. "NUBAN" means Nigerian Unified Banking Account Number.

1.18. "OTP" means One Time Pin, used to authorize transactions or processes.

1.19. "Paga" means the financial services products offered by Pagatech, with a central feature being a transactional account(s) that may be used in relation to a wide variety of services.

1.20. "PIN" means personal identification number being the secret code you choose for secure use of (and access to) your Paga account.

1.21. "Products" means Paga products, including person-to-person money transfers, bill payments, airtime top-ups, Paga retail payments services or other Merchant products and services provided through Paga.

1.22. "Registered phone number" means any phone number that has been registered on Paga.

1.23. "Services"; means any products and services provided to the customer as part of Paga.

1.24. "Paga Wallet" means an electronic stored value account on Paga used to perform transactions.

1.25. "Partner Service Provider:" means any person or entity that offers its services or products through Paga.

1.26. "Transaction Savings Wallet": An electronic stored value savings account on Paga, used by the customer or Agent to save, earn interest and perform typical Paga transactions

1.27. "SMS" or "Short Message Service" means a standard communication service on GSM phones, which is used to exchange short text messages between mobile devices.

1.28. "USSD" or "Unstructured Supplementary Service Data" means a real-time messaging channel accessed from a mobile phone and allows users to interact with Paga.

The Paga Offering

2.1. Paga is a service offered by Pagatech and designed to allow you::

2.1.1. Sign up as a customer

2.1.2. Receive access to our broad set of products and features within Paga

2.1.3. Credit a Paga account with cash by;

2.1.3.1. depositing at our agent locations.

2.1.3.2. depositing at any of our collection banks.

2.1.3.3. transferring funds into Paga from a Linked Bank Account/Card.

2.1.3.4. receiving money into Paga from another customer.

2.1.4. pay or transfer money to a third party for personal reasons or as payment for physical or virtual goods or services already received or to be received in the future.

2.1.5. transfer to a bank account.

2.1.6. transfer to a Paga Account.

2.1.7. pay Merchants

2.1.8. receive money from another party for personal reasons or as payment for physical or virtual goods or services already provided or to be provided in the future

2.1.9. withdraw cash at any of our Agent locations, Paga centres or ATMs.

2.2. No interest will be paid on the balance in Paga Accounts or Wallets unless you are subscribed to a product on Paga that pays interest.

2.3. Any available funds in your Paga Account or Wallet can be utilized.

2.4. These Terms of Use apply to all channels through which transactions may be carried out on Paga, including SMS; IVR; Online/Internet; Online/Mobile phone application; USSD; Paga centres and Paga’s Agent network.

2.5. We will endeavour to notify you of additional features that may be offered on Paga and where necessary, the applicable means or requirements to activate any such features.

Opening a Paga Account

3.1. We strongly recommend that minors obtain consent from their parents or guardians before joining Paga, providing information to any third party or sending any information about themselves to anyone over any Paga channel.

3.2. To sign up to join Paga, an active GSM or CDMA mobile phone subscription on any supported mobile network is required.

3.3. Customers are limited to one (1) Paga Account or Wallet per phone number. Multiple phone numbers can however be linked to the same Account or Wallet.

3.4. Upon signing up, each account will be assigned a Paga account number.

3.5. To set up your Account or Wallet, Paga requires your personal details including your name, phone number, means of identification and BVN. You must provide complete and accurate information. Unregistered customers will not be able to receive cash to their phone number. They will also have limited use of Paga pending registration. Also, where an Account is opened without BVN or wrong BVN, such an Account will be restricted until the BVN is provided and or updated on such Account. Paga is required by the CBN to verify all BVNs collected.

3.6. By providing your BVN on the Paga platform, you authorize Pagatech to collect and save your data from the BVN database as part of our KYC information to fulfil regulatory requirements. All KYC data collected will be treated as confidential. You also permit us to use your BVN to monitor, prevent, detect fraudulent activities, and share the same with CBN-authorised BVN stakeholders, for the purpose of deterring financial fraud.

3.7. In the process of verifying your identity and BVN, Pagatech has the sole discretion to refuse any Account or Wallet opening application for any reason. In addition, we reserve the right to ask you before opening an Account and at any point during your use of Paga for supplementary information and identification documents as well as any supporting documents that we may deem necessary.

3.8. We reserve the right to screen all individuals and businesses against applicable sanction lists and the BVN watchlist database and may decline account opening applications in the event they are found to be on any of the lists.

3.9. We reserve the right to immediately suspend or withdraw an Account or Wallet if we have reasonable grounds to believe that there may be a breach of security of that Account or Wallet, we suspect unauthorised or fraudulent use of that Account or we are required by law to do so.

3.10. You must provide a single verified means of identification to set up your Account, and Pagatech reserves the right to suspend any Wallet created with more than one means of identification.

3.11. If fraudulent activity is associated with the operation of your Account or Wallet, you agree that we have the right to apply restrictions to your Account and report to appropriate law enforcement agencies.

Adding Funding Sources to your Account

4.1. You may access the available funds in other sources asides from your Account or Wallet. Customers may add Bank Accounts and cards to their Paga Wallet or Account.

4.2. Confirmation and authorization of your other funding sources by an OTP, 3D Secure or other authorization methods as applicable are required. Once authorized, you grant Pagatech and your bank the authority to debit your source(s) at your request or at any reoccurring schedule you have indicated. Your authorization is confirmed by Pagatech with a successful login into the Paga platform with your password or via the use of a PIN on USSD.

4.3. Once a funding source has been added to your Account or Wallet, you grant Pagatech the authority to save and store the details of your funding source.

4.4. Our information security and privacy policy will be applicable to all information stored and processed.

4.5. Upon set up and authentication of the funding sources added to your Account or Wallet, all payments processed from your Account or Wallet are deemed genuine, and you shall not hold Paga liable as a result of any fraud, your oversight or compromise.

4.6. You will be responsible for any charges or penalties from 3rd parties or your bank that occurs because of transactions that occur on your Account or Wallet and or Transaction Wallet.

4.7. You will be responsible for managing your funding sources, in terms of additions, removals and updates e.g expired debit cards.

Transacting

5.1. You may access the available funds in your Account or Wallet at any time using any of the channels you choose, including your mobile phone and the Internet. While we make every reasonable attempt to provide the services as described in our marketing and educational materials, we offer the services "as is" and without any warranties.

5.2. All payments will be processed in Nigerian local currency i.e., Naira and Kobo.

5.3. Each transaction will be identified by a unique 5-character Transaction ID, which is used to track and identify all transactions carried out on the Paga network. This number is important for a variety of uses, including dispute resolution.

5.4. Pagatech will send you a receipt of all transactions effected from your Account or performed at an Agent; this message may be sent via SMS, email, or another available channel.

5.5. Some transactions on Paga’s USSD channel may require you to input your pre-configured PIN, you are solely responsible for maintaining the confidentiality of the PIN and login details of your Account. You must protect the secrecy of your PIN and login details and prevent fraudulent use of the same.

5.6. As required by the CBN, there are daily limits on your Account or Wallet. You can increase or reduce these limits by providing the required information, subject to the restrictions placed in terms of paragraphs 5.9.

5.7. Your Account or Wallet will be credited with any deposits made into it, and the credit will be available for transactions immediately after they are cleared.

5.8. We will verify and confirm any record of a deposit into your Account. Our records will be taken as correct unless the contrary is proved.

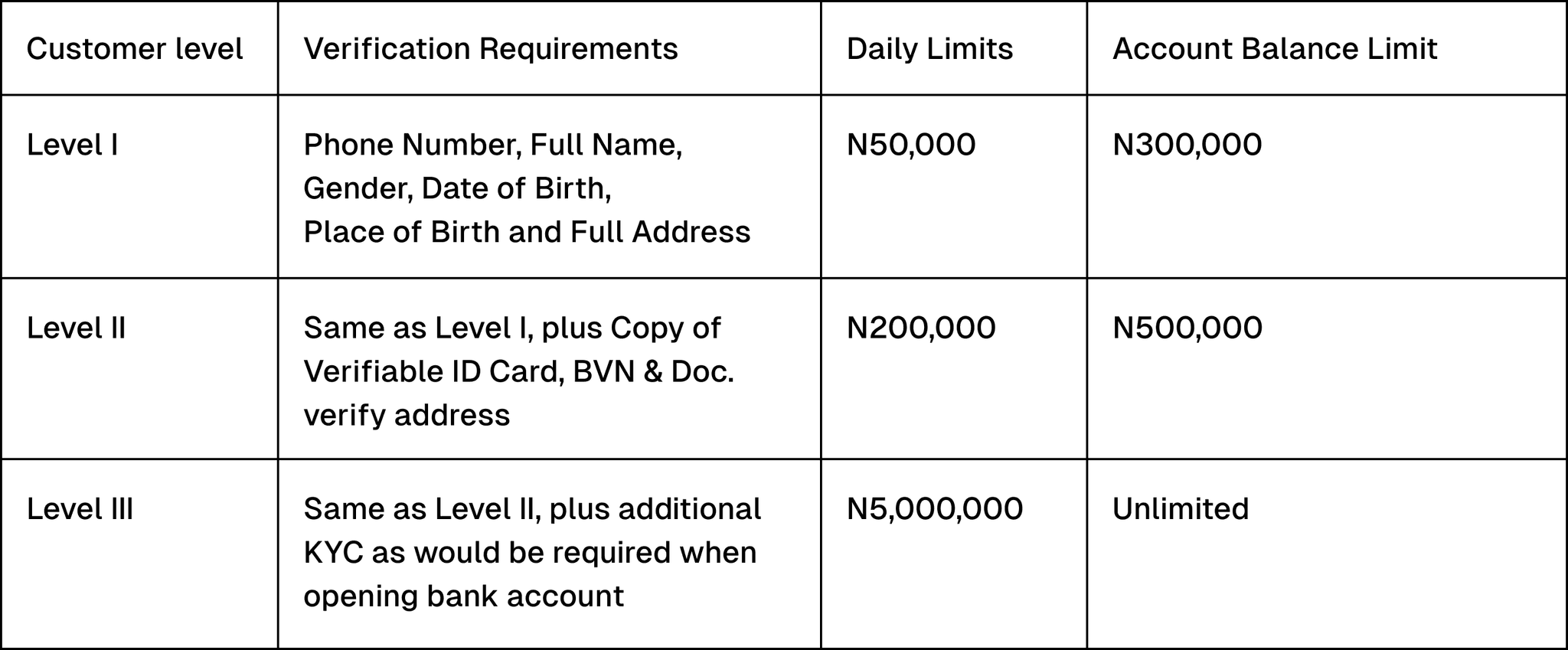

5.9. The table below outlines the customer classification Pagatech adopts as the KYC levels along with the applicable transaction limits. You may not withdraw, transfer or make any payments that together exceed any of the transaction or daily limits defined for your category. Should you attempt to exceed any applicable limits, your transactions will be declined. Pagatech may, acting reasonably and in accordance with regulation set by the CBN, vary the limits at any time and any variation will be notified to customers. Where a deposit exceeding the transaction limit for your category is made to your Account, we will notify you to upgrade your Account to the category that applies to such deposit within seven (7) days. In the event that you fail to upgrade your Account to the required category, we reserve the right to place a restriction on your Account until such an upgrade to the required category is effected.

5.10. For the avoidance of doubt, please note that some transaction limits may be further reduced from the approved CBN limits, this may be done based on channels or types of transactions as part of our risk control process.

5.11. You undertake throughout the duration of your use of Paga to comply with anti-fraud and money laundering regulations applicable in Nigeria. You undertake to respond diligently to any request from Pagatech or a regulatory or judicial authority regarding any anti-fraud and money laundering activity on your Account.

5.12. Any breach of the anti-fraud and money laundering regulations by you constitutes a serious breach of this Terms of Use and we reserve the right to immediately suspend or close your Account.

5.13. The proceeds from suspected fraudulent or money laundering transactions shall be kept by Pagatech pending an internal decision or a judicial or administrative decision.

Bank Account Direct Debit

6.1. Direct Debit Service allows you to make payments for goods and services through the Paga platform and other payment systems/channels using your bank account as the funding source.

6.2. To be eligible to use the Direct Debit Service, you must be an account holder with any of Pagatech’s partner banks and possess a text-enabled cellular/wireless telephone number

6.3. You must initiate account registration for Direct Debit Service by providing Pagatech with your Bank Account Number, Date of Birth and OTP provided to you by your Bank, via any of the supported Paga payment systems/channels, however, we may require additional information to register your account.

6.4. By requesting this service, you hereby authorize your Bank and Pagatech, directly or through third parties, to make any inquiries we consider necessary to validate your identity and or authenticate your identity and account information. This may include asking you for further information and or documentation about your account usage or identity or requiring you to take steps to confirm ownership of your email address or telephone number or financial instruments and verifying your information against third-party databases or through other sources.

6.5. All payments via the Direct Debit Service are authorized by your Bank and authenticated by you, by way of OTP.

6.6. Upon set up and authentication of the Direct Debit Service, all payments through this service are final and your Bank or Pagatech will not be held liable for any unauthorised transaction as a result of your oversight or compromise.

6.7. You set up reoccurring payments, you hereby authorize Pagatech to debit your wallet, and if a funding source is used, you authorize Pagatech and your bank to debit the specified amount at the specified period.

Recurring or Subscription Payment on your Account

7.1. You may set up recurring payments on Paga. Once set up, you are authorizing Paga to debit your Account, bank account, or saved debit/credit card, as the case may be, the specified amount at the specified period. All transactions are final. If your Paga account or bank account is not sufficiently funded or your debit/credit card is declined at the time of the transaction the transaction will fail.

7.2. You may also permit a 3rd party to set up a subscription recurring payment to debit your Account or saved bank account or debit/credit card as the case may be. All transactions are final. If your Paga Account or bank account is not sufficiently funded or your debit/credit card is declined at the time of the transaction the transaction will fail.

Fees, Charges and Payment Terms

8.1. While many transactions on Paga are free to the customer, some transactions do carry a fee. Our fee schedules are available at all our Agent locations, and field offices, through communication with our Customer Services or by accessing our website. The fee schedule provides details on the fee amounts and the method and source of payment for such fees. We reserve the sole discretion to revise the fee schedule from time to time.

8.2. When you initiate and confirm a transaction on Paga, you agree to be bound by and pay for that transaction. Do not commit to a transaction unless you are ready to pay and have checked that all provided information is accurate as all confirmed and completed transactions are final.

8.3. Paga is designed to make payments convenient, so we allow you to make payments using several different funding sources e.g., your Linked Bank Accounts or cards. When you provide us with a funding source, you also authorize::

8.3.1. The collection and storing of source information along with other related transaction information.

8.3.2. The crediting and debiting of your chosen source when you perform transactions on Paga.

8.4. When you make a payment, you authorize us (and our designated payment processor) to charge the full amount and any charges related to that transaction to the funding source you designate for the transaction. If your payment results in an overdraft or other fee from a related party, liability for such fees or penalties will rest solely with you.

8.5. To prevent financial loss or possible violations of the law, Pagatech reserves the right to use its discretion in disclosing details of any payments associated with you with funding source issuers, law enforcement agencies, or impacted third parties (including other users). Such disclosures may originate from an order of any trial court with the jurisdiction to compel such a disclosure.

8.6. Account Maintenance Fee::

8.6.1. In addition to the transaction fees, you will also be required to pay an Account maintenance fee at the end of each month which will be calculated on the total transactions that have been initiated on your Account; The total transactions shall not include any reversals of the transactions initiated on the Account. Value-added tax shall also be charged on the Account maintenance fee.

8.6.2. In the event that the balance on your Account is not sufficient to cover the Account maintenance fee, the fee shall be deducted from your Wallet once it is funded.

8.6.3. The total transactions shall not include any reversals of the transactions initiated on the Account; the Account maintenance fee shall not include the platform fees.

8.6.4. The Account maintenance fee shall be displayed on your Account statement.

Merchant Transactions

9.1. When making a payment to a Merchant on Paga, you will be required to confirm the transaction. At this time, you may also be requested to enter your Password or PIN depending on the channel. By entering your Password or PIN to confirm the transaction you agree and confirm that you authorised the transaction. You cannot directly reverse or cancel any payment once it has been approved by you.

9.2. When making a payment on a merchant website using Paga, you will be required to log into your Account, before payment can be made, in which case clause 5 will still be applicable.

9.3. As we are unable to reverse or charge back any payments made, should you have a dispute with any Merchant, you should resolve such disputes with the Merchant directly.

9.4.Disputes between you and a Merchant will not affect our right to recover payments from you

Paga Online Services

10.1. You agree that claims against Pagatech may only be brought in your individual capacity and cannot be brought as a class member in any purported class or representative action proceeding.

Security and Unauthorized Use

11.1. When signing up for an Account, you will be prompted to create a unique username, and password, and may be prompted to create a Personal Identity Number (PIN) for applicable channels, you will also be asked to provide answers to one or more security questions of your choosing and select a security image. You are responsible for the safekeeping and proper use of these security data.

11.2. You are responsible for protecting your password, PIN, and login details. In view of this, you are responsible for all transactions that occur on your Account as well as applicable channels and you undertake to indemnify and hold us harmless against any claims made in respect of transactions made on your Account.

11.3. If at any time you believe or discover that your password or PIN has been stolen or compromised, we advise that you immediately, log into your Account and change the password or PIN. If you are unable to change your security details we advise you to contact our Customer Services team immediately. We will place your Account on hold to prevent any or further transactions from being carried out as soon as we reasonably can. You will remain responsible for all transactions that occur until your Account is put on hold.

11.4. Should you dispute any purchase or withdrawal debited to your Account, you will be required to prove that it lacked your authorization. Such transactions will be investigated once we receive an affidavit clearly stating that you had not authorised the transaction, supported by proof of this.

11.5. We may ask certain questions to confirm your identity when you call Customer Services. This method gives us your authorisation to service your Account and execute your instructions. However, please note that we will never ask for your Password or PIN. We advise that you do not disclose your Password or PIN to anyone under any circumstance.

11.6. From time to time, we may investigate any actual, alleged or potential violations of these Terms and Conditions. You agree to cooperate fully in any of these inquiries.

Deposit Insurance

12.1. Unless otherwise stated, all funds in your Account shall be insured up to the maximum coverage level for depositors in line with the Nigerian Deposit Insurance Act. This protection is provided by the Nigerian Insurance Deposit Corporation.

Statements and Transaction Records

13.1. You may request a record of transactions on your Account at any time either via your mobile phone, online, or from a Paga field office. Unless otherwise noted at the time of the request, all records of transactions will be provided free of charge, subject to SMS or network charges.

13.2. You must inform us within thirty (30) days of the date of any transaction if you think such a record of transactions is inaccurate. Should you fail to do this within this timeframe, it will be interpreted that you waive the right to dispute any transactions reflected on the statement or to recover any losses from unauthorised transactions reflected in the statement.

Suspension and Closure of Accounts

14.1. We may suspend, restrict, or terminate the provision of our services (in whole or in part) and or close your Account without any liability whatsoever under the following circumstances::

14.1.1. upon receiving a request from you at any time to close your Account, we will do so.

14.1.2. if you notify us that your phone has been lost or stolen or your PIN has been compromised, we place your account on hold Account.

14.1.3. if in any way we know or suspect your Account is being used fraudulently, negligently or for illegal activities or if we must do so to comply with the law, we may close your Account, restrict activity on your Account or suspend access to your Account.

14.1.4. in the event the suspected fraudulent or suspicious activity has been confirmed we will be required by the regulators to report the associated BVN to the BVN watchlist database, with all regulatory penalties applicable.

14.1.5. if we believe that you are in breach of these Terms of Use, you are trying to compromise our systems, you are unreasonably interfering with any services provided by us, or for any other purpose in the protection of our interests, we may close your Account

14.1.6. should you enter the incorrect Password or PIN on three (3) consecutive occasions, we will restrict access to your account.

14.2. If we close your Account, you must ensure that all debit orders linked to this Account are removed within 30 days as these debit orders will be declined after this period and Paga will not accept any liability resulting from these declined debit orders.

14.3. We will not be responsible to you for any direct, indirect, consequential, or special damages arising from any act or omission by us or any third party for whom we are responsible, whether arising in contract, delict or statute, if we close or suspend your Account in accordance with this Terms of Use.

14.4. In any case where your Account is closed for any reason and has a balance of funds, upon your request to Customer Services, the balance will be made available to you for withdrawal barring any legal or regulatory provisions against such.

14.5. We reserve the right to blacklist an Account holder or block an Account for failure to comply with these terms.

Account Dormancy and Unclaimed Funds

15.1. An Account shall become inactive if there has been no customer or depositor-initiated transaction for a period of six (6) months after the last customer or depositor-initiated transaction.

15.2. An Account shall become dormant if there has been no customer or depositor-initiated transaction for a period of one (1) year after the last customer or depositor-initiated transaction.1

5.3. Inactive Account may be classified as active with any customer-initiated transactions or any deposits into the Account.

15.4. Customer or depositor-initiated transactions include cash deposits, withdrawals and transfers to or from the account, bill payments and other transactions that may be consummated on the Paga platform.

15.5. In a situation where an Account becomes dormant, Pagatech will::

15.5.1. notify the Account holder three (3) months to dormancy on the status of the Account and upon dormancy, to encourage the customer to transact.

15.5.2. contact the next of kin or alternative contact if still unable to reach the customer after three (3) months of dormancy.1

5.5.3. continue to reflect balances of dormant Accounts in wallets.

15.5.4. retain all records of dormant accounts irrespective of the years of dormancy and shall reactivate such accounts upon request of the legitimate account owner.

15.5.5. ensure the customer provides satisfactory KYC evidence of account ownership, to reactivate dormant accounts.

15.6. All funds deposited into any of Pagatech’s collection accounts from an individual or depositor without sufficient details as to the rightful beneficiary will be classified as unclaimed funds.

15.7. Pagatech shall employ adequate efforts to reach the collection bank for details of the beneficiary.

15.8. In the event funds deposited in the collection/pool account remain unclaimed for a period of six (6) months. Pagatech shall pool all such funds into a suspense account at a bank. The funds shall be warehoused until the beneficiary shows up or the corresponding bank debits Paga’s pool account.

Notices

16.1. The physical address, email address or telephone number you supply during sign-up are regarded as the preferred channels via which notices may be given and documents in legal proceedings may be served. You must notify us immediately should your physical, postal, email address or mobile phone number change.

16.2. We are entitled to send information to you via SMS to the registered phone number associated with your Account and as amended from time to time.

16.3. We are entitled to send any notice to an email address specified on your Account. This clause pertains to customers who have accessed and used Paga services online or via the Paga mobile application.

16.4. Any correspondence that we send to you by courier or post will be considered to have arrived within seven (7) days of sending the same and any correspondence that we send to you by email or SMS will be considered to have arrived on the day that it was sent to you, unless the contrary is proved

16.5. You should send any legal notice to us by post to our address at 176 Herbert Macaulay Way, Yaba, Lagos, Nigeria.

Privacy Policy

17.1. When you sign up for Paga you will be required to provide us with your name, email, selfie and facial Id for liveliness check, gender, and birth date, among other information. In some cases, we may ask for additional information for security reasons or to provide specific services to you. For face recognition and liveliness check, we capture a three-dimensional map of your face and analyze your facial expressions. This face data is processed in real time to confirm your identity and to ensure that the selfie being taken is of a live user.

17.2. You may change your personally identifiable information on Paga at any time by contacting Customer Service or accessing your account profile online. Some of such information will be updated immediately, while others may require further verification before it is updated.1

7.3. When you access Paga through a computer, mobile phone, or other devices, we may collect information from that device regarding your browser type, location, and IP address, as well as the pages you visit for security purposes.

17.4. When using our mobile applications, we ask for access to your phone contacts so you may more easily make payments to people in your phone contacts via the mobile application. We also give you the additional option to opt-in for your contacts to be uploaded to our servers. By uploading your contacts to our servers, you can now access your phone contacts on other Paga channels for ease of transacting with people in your contacts. We will only upload to our servers if you give us additional explicit permission. We will not share your contacts with any 3rd party.

17.5. When using our mobile applications, we ask for permission to be granted access to the following features::Camera: allows you to take a profile picture, selfie and facial Id for liveliness check, scan, and capture payment card details to make payments easier and faster;Photo Library: allows you access to your photos as an optional source for your profile picture;Fingerprint or Facial Recognition: allows you securely log into the application.We will only ask for permission the first time the user attempts to use any of these functions. Thereafter the user may manage access through the settings option on the device.The biometric/ face data collected is solely used for the purpose of authenticating your identity and preventing fraud. We do not use this data for any other purpose. The information is processed in a manner that is secure and in compliance with applicable laws and regulations concerning biometric/face data.

17.6. We are required to retain the details of transactions or payments you make via Paga after the transaction is completed. This information will only be made available to third parties if required by law or to our representatives, professional advisers or external third-party service providers under the same obligation of confidentiality, for the purpose of enhancing our services to you. We will take all reasonable steps to ensure that your data is treated securely and in accordance with our Privacy Policy

17.7. You agree that your information, including your personal information, your telephone conversations with our Customer Services and your transactions may be recorded and stored for record-keeping purposes for up to five (5) years from the date of closure of your Account.

17.8. We use server firewalls and encryption to keep your Account information safe during transmission and in storage. We also use automated and social measures to enhance security, such as analyzing account behaviour for fraudulent or otherwise anomalous behaviour, may limit the use of Paga features in response to possible signs of abuse, and may suspend or disable accounts for violations of our customer terms and conditions.

17.9. Unless stated otherwise, our current privacy policy applies to all information that we have about you and your Account. We advise that you check our website periodically for changes to our privacy policy.

17.10. You need to refer to our Privacy Policy on this website for further details as that privacy policy explains how we use and collect your information.

Disputes and Reversals

18.1.I f you believe that an unauthorized or otherwise problematic transaction has taken place on your Account, you agree to notify us immediately, to enable us to take action to help prevent financial loss.

18.2. All claims against us related to payments should be made within thirty (30) days after the date of such payment. It will be taken that you waive all claims against us, to the fullest extent of the law after the said period.

18.3. You are responsible for and agree to indemnify us for all reversals, chargebacks, claims, fees, fines, penalties, and other liability incurred by us (including costs and related expenses) caused by or arising from payments that you authorized or accepted.

18.4. If you enter a transaction with a third party and have a dispute over the goods or services you purchased, we have no liability for such goods or services. Our only involvement regarding such a transaction is as a payment agent.

18.5. We may intervene in disputes between users concerning payments but have no obligation to do so.

18.6. It is your responsibility to remit any taxes that apply to your transactions and are not normally included in the cost of the Paga transaction. You agree to indemnify and hold us harmless from and against any claim arising out of your failure to do so.

18.7. The transaction ID and transaction details will be required to resolve all disputes

General

19.1. We try to always keep Paga available, bug-free, and safe, however, you use it at your own risk. We are providing Paga "as is" without any express or implied warranties including, but not limited to, implied warranties of merchantability, fitness for a particular purpose, and non-infringement. Paga is not responsible for the actions, content, information, or data of third parties, and you release us, our directors, officers, employees, and agents from any claims and damages, known and unknown, arising out of or in any way connected with any claim you have against any such third parties.

19.2. We reserve the right to change, modify, add, or delete portions of these Terms of Use, at any time without prior notice to you. It is your responsibility to check these Terms and Conditions periodically for changes. Your continued use of the website or Paga following the posting of changes will mean that you accept and agree to the changes.

19.3. You are responsible for your connection to the mobile phone networks, the Internet and all costs associated with these same connections.

19.4. We are not responsible for any loss arising from any failure, malfunction, or delay in any mobile phone networks, mobile phones, ATMs, the Internet, or terminals or any of its supporting or shared networks, resulting from circumstances beyond our reasonable control.

19.5. We may allocate any money received from you or held on your behalf to settle any outstanding balance on your Account.

19.6. All copyright, trademarks and other intellectual property rights used as part of our services or contained on our websites, documents or other materials are owned and controlled by Pagatech or its licensors. You agree that you acquire no rights to the same and shall not copy, reproduce, republish, upload, post, transmit or distribute such material in any way, including by e-mail or other electronic means and whether directly or indirectly and you must not assist any other person to do so.

19.7. You acknowledge and agree that these Terms and Conditions are governed by Nigerian law and any breach of these Terms and Conditions will be considered as having taken place in Nigeria.

19.8. The Parties shall use their best efforts to amicably settle all disputes arising out of or in connection with the performance or interpretation of these Terms and Conditions. Any dispute or differences arising out of the construction, interpretation or performance of the obligations created under this relationship which cannot be settled amicably within one (1) month after receipt by a party of the other party's request for such amicable settlement may be referred to arbitration under the Lagos State Arbitration Law 2009. The arbitration award shall be final and binding. The place of arbitration shall be in Lagos, Nigeria and the language of Arbitration shall be English language.

Privacy Policy

Protection of Privacy

Pagatech Limited (“Pagatech”, “Paga”, the “Company”, or “we” or “us”) values your Personal Data and we are committed to protecting your privacy whenever you interact with us. Please read this Privacy Notice (the “Notice”) to understand our policies, processes, and procedures regarding the processing of your personal data.

By this Notice, we explain to you how your Personal Data is collected, used, managed, transferred and or deleted by Pagatech and also explain how you can update your Personal Data with us and exercise your rights in respect of the Personal Data provided to us.

The Information we Collect

To access the Paga Services and for optimal use of the Paga mobile application/website, we collect personally identifiable Information which you voluntarily provide to us.

Personally identifiable information refers to the personal information you submit, when you sign up or any information that can be used to identify or contact you (e.g. email address, password, name, address, telephone number, business name, camera sensor data, selfie image, facial ID, bank details, and other unique identifiers including but not limited to MAC address, IP address, IMEI number, IMSI number, SIM and others). For ease of transacting, we may also collect your contact details, only if your permission to do so is granted.

For face recognition and liveliness check, we capture a three-dimensional map of your face and analyze your facial expressions. This face data is processed in real time to confirm your identity and to ensure that the selfie being taken is of a live user.

We also collect non-personally identifiable information including but not limited to dynamic IP address, geolocation data, screen size and cookies data. We use technical methods to collect and store personal information such as cookies, JWT, web beacons etc. We will not share or disclose this information with third parties except as a necessary part of providing our users with access to our website and services. By visiting and using our website, you agree to our use of cookies in line with Pagatech's policies.

We may request permission to access your contacts in your phonebook on your mobile device to enable you to sync your contacts and list them as beneficiaries on the Paga mobile application. You can manage access to your contact list through the application settings at any time.

Uses of Information

We use your personally identifiable information to:

provide our services and supporting customer support

profile Paga users and administer Paga pre-paid accounts

resolve disputes, collect fees and troubleshoot problems

prevent potentially prohibited or illegal activities and enforce our User Agreement

customise, measure and improve our services

customise and improve the layout of our website

compare information for accuracy and verify with third parties

update our databases and provide user support

provide you with information about other goods and services we offer that are similar to those that you have already purchased or enquired about.

authenticate your identity and prevent unauthorized access and fraud. The biometric/ face data collected is solely used for this purpose. We do not use this data for any other purpose. The information is processed in a manner that is secure and in compliance with applicable laws and regulations concerning biometric data.

We use the information from your contact list on your mobile device to facilitate easy money transfers to other users.

What Constitutes your Consent?

Where processing of Personal Data is based on consent, Pagatech shall obtain the requisite consent at the time of collection of the Personal Data. In this regard, you consent to the processing of your Personal Data when you access our platforms, or use our services, content, features, technologies, or functions offered on our website or other digital platforms. You can withdraw your consent at any time, but such withdrawal will not affect the processing of your data which we carried out lawfully based on consent given before your withdrawal.

We may retrieve Personal Information about you from third parties and other identification/verification services such as your financial Institution, payment processor and verification services. With your consent, we may also collect additional Personal Information in other ways including emails, surveys, and other forms of communication. Once you begin using our services through your Paga account, we will keep records of your transactions and collect information of your other activities related to our services. We will not share or disclose your Personal Information with a third party without your consent. We will not use your information or seek your consent to use your information for the propagation of atrocities, hate, child rights violation, criminal acts and anti-social conducts.

Sharing of Information

Pagatech assures you that it shall only obtain your data with your consent and that your data shall only be used for the purpose for which it was obtained. However, we may share your Personal Data with companies within the Pagatech group, and service providers engaged by us to provide services to Pagatech subject to appropriate data security and protection. In addition, we may transfer your Personal Data out of Nigeria in line with the requirements of the Nigeria Data Protection Act, 2023. Paga shall also share your Personal Data with third parties directly authorized by you to receive Personal Information, such as when you authorize a third-party service provider to access your account. The use of your personal information by an authorized third party shall be subject to the privacy policy of the third-party and Paga shall not bear any liability for any breach which might arise due to your authorization. Paga shall also share your Personal Information if it is believed that such sharing is required to satisfy any applicable laws, regulation or government request.

Our website may contain third-party links or links to other websites. Please be advised that we are not responsible for the privacy practices or contents of these sites and shall not be responsible for your use of such websites. We encourage our users to be aware of when they leave our website and to read the privacy statements of these sites. You should evaluate the security and trustworthiness of any other site connected to this site or accessed through this site before disclosing any personal information to them. Paga will not accept any responsibility for any loss or damage in whatever manner resulting from your disclosure of your personal information to third parties. However, Paga shall also make all reasonable efforts to ensure that adequate safeguards have been put in place to prevent unauthorized access and to ensure confidentiality of your personal information.

Acknowledgment

You acknowledge that by using the Paga services, some of your personal information will be passed on to any person whom you receive Paga money from, or send Paga money to, and will be available to any third party involved in the operation of the service including without limitation, Paga Agents and partner banks.

Your Rights

You can exercise the following rights with respect to your Personal Data with Pagatech:

a) request for and access your Personal Data collected and stored by Pagatech;

b) withdraw consent at any time. For example, you can withdraw your consent to receipt of our marketing or promotional materials or unsubscribe to our newsletters;

c) object to automated decision making;

d) request rectification and modification of Personal Data kept by Pagatech;

e) request for deletion of your Personal and Face Data;

f) be informed of and entitled to provide consent prior to the processing of Personal Data for purposes other than that for which the Personal Data were collected;

g) request that Pagatech restricts processing of your Personal Data; and

h) request for information regarding any specific processing of your personal data.

You may exercise any of these rights by sending an email to service@paga.com where your requests will be treated promptly.

Account Monitoring

You accept that Paga shall have the right to monitor your account usage and if required, will disclose personal information to local enforcement or investigative agencies or any competent regulatory or governmental agencies to assist in the prevention, detection or prosecution of money laundering activities, fraud or criminal activities.

Paga Employee Obligation

Paga employees who handle personal information are under an obligation to treat it confidentially and may not disclose it to third parties. Paga employees are also responsible for the internal security of the information. Employees who violate Paga’s privacy policies are subject to the company’s disciplinary procedures.

Submitting Information Through Paga

Any person submitting information to Paga through our platform may be granted access rights to that information. Paga has developed systems that enable users to access and correct their personal information submitted to it. Paga is committed to ensuring that personal data processed by the company is accurate and up to date in line with the provisions of the Nigeria Data Protection Regulation (NDPR) 2019.

In order to ensure that your personal data with the company is current, complete and accurate, please update us if there are changes to your personal information by informing the company?s DPO via the stated contact details or the Human Resources Unit. We shall take it that your records with the company is current, complete and accurate if we do not receive any update from you.

Privacy Policy Updates

Paga may at any time amend, delete or add to its Privacy Policy by giving notice of such changes or posting a revised version of our Privacy Policy on Paga?s online portals. Any change will be made unilaterally by us and you will have been deemed to have accepted these changes by your continuous use of Paga?s services after the revised Privacy Policy is uploaded. You further agree that it is your sole responsibility to check for updates of the Privacy Policy.

If you have a Paga Account, Paga will give you 1 month notice of any changes, with the changes taking effect once the 1-month notice period has elapsed. The 1-month notice period will not apply where a change relates to the addition of a new service, extra functionality to any existing services or any other change which we believe in our reasonable opinion to neither reduce your rights nor increase your responsibilities. In such instances, the change will be made without prior notice to you and shall be effective immediately upon giving notice of it.

If you do not accept any change, you will be required to close your Paga prepaid account, otherwise you will be deemed to have accepted it. Any closure of account still renders you liable to Paga for any liability incurred by you prior to closure.

Correspondence

Should you send us correspondence including chats, calls, emails and letters, we will retain such information in the records of your account. We will also retain customer service correspondence and other correspondence from Paga to you. The rationale for this retention is to keep records of our relationship, measure and improve customer service and to investigate potential fraud and violations of our User Agreement. We may, over time, delete these records if permitted by law.

Questionnaires & Surveys

From time to time, Paga may offer optional questionnaires and surveys to our users for such purposes as collecting demographic information or assessing users' interests and needs. The use of information collected will be explained in detail in the survey itself. If we collect personal identifiable information from our users in these questionnaires and surveys, the users will be given notice of how the information will be used prior to their participation in the survey or questionnaire.

Security

Paga is committed to managing customer information with the highest standards of information security. We protect your personal information using physical, technical and administrative security measures to reduce the risks of loss, misuse, unauthorized access, disclosure and alteration. We use computer safeguard such as firewalls and data encryption, enforce physical access to our buildings and files and only authorise access to personal information to only employees who require it to fulfil their job responsibilities.

The security of your Paga prepaid account also rests on the protection of your PIN. You should not share your PIN with anyone and no employee of Paga will ever ask you for either of these so any email or correspondence requesting for such information should be treated as unauthorised and suspicious and forwarded to info@pagatech.com. We will endeavor to respond to such emails as soon as possible.

Should you share your PIN with any third parties, such third parties will have access to your account and your personal information, and you may be responsible for any actions taken using this information. In the event you suspect a third party has gained access to your PIN, please log into your Paga profile, change it and notify us straightaway.

Retention of your personal data

Paga takes appropriate measures to ensure that your Personal Data (i.e. email address, password, name, address, telephone number, business name, camera sensor data, selfie image, facial ID, bank details, and other unique identifiers including but not limited to MAC address, IP address, IMEI number, IMSI number, SIM and others) is only processed and retained for a period in line with the purposes set out in this Notice, as is stated under our Terms and Conditions or as required by applicable laws, and for no longer than five (5) years unless a longer retention period is legally required. We will also determine what action is to be carried out once the applicable retention period has expired.

As part of our identity verification and onboarding process, the application uses the TrueDepth APIs through a third-party SDK solely for real-time biometric liveness detection. TrueDepth data is processed only on your device, is not stored by Paga or the SDK provider, is not transmitted off your device, and is discarded immediately after the liveness check is completed. This data is never used for tracking, analytics, advertising, or any purpose other than confirming that the user is a real, live person during onboarding. This aligns with the strict requirements for processing biometric and facial data under applicable privacy regulations.

All other personal information you provide to us (including the selfie image captured after liveness verification, which is separate from TrueDepth data) may be stored on our secure servers, secure physical locations, and cloud infrastructure (where applicable) to ensure seamless service delivery and business continuity. The data we collect from you may be transferred to or stored in secure data centers operated by globally-recognized vendors. Whenever your information is transferred or stored in other locations, we take all necessary steps to ensure that your data is handled securely and in accordance with this Privacy Policy.

Inquires

Paga is responsible for ensuring that our day-to-day procedures are aligned with this Privacy Policy. Should you have any questions about this privacy statement, Paga's information services or your transactions on Paga, you can contact us via our customer help lines or by email to rmc@paga.com.

Security

Paga is Safe and Secure

At Paga, confidentiality and security are top priorities. We are regulated by the Central Bank of Nigeria (CBN) and are compliant with all their regulator policies and the policies of all other relevant regulatory bodies.

To ensure that our solution is secure, we have implemented multiple layers of security in order to protect our systems and most importantly, your account and personal details. Paga is designed with state-of-the-art security features, which include anti-money laundering and fraud prevention.

Your Paga account is associated with your mobile phone number, but your money is not " on your phone " . Even if your mobile phone handset is lost or stolen, nobody can access money in your Paga account without your authorization. With Paga, you are always in control of your cash.

Here are the extra measures we have in place to ensure your money is always safe:

Personal Identification Number (PIN)

On Paga, you create your PIN and it is known only to you. All transactions that are processed on Paga must be authorised by your PIN entry. For all SMS transactions, we initiate an automated call to you for PIN authorisation. Online transactions are not processed until you enter your PIN via virtual keypad. We will never ask you to verbally confirm your PIN over the phone or any other channel. To reduce the risk of an account breach, we ask that you do not share your PIN with anyone.

Username and Password

Online and mobile phone application users login with a username and password. On Paga, you create your username and password and this information is only known to you. To reduce the risk of an account breach, we ask that you do not share your username or password with anyone.

Security Questions

When you activate your account online or using the mobile phone application, we require you to select and answer security questions. This information is only known to you. In the case that we detect a possible account breach or do not recognise the device you are logging in from, we will ask you to answer the security questions you selected in order to verify your identity. For online access, we have also added an extra feature called the ID phrase. This phrase is created by you when you register for online access. Please look out for this phrase. It will always appear when you log into your Paga account online. If there is any instance when the phrase does not appear, please do not provide any further information on your account. Immediately leave the site and report the details to Paga at fraudwatch@mypaga.com or call our customer service line on 0700-000-PAGA (0700-000-7242).

Access to data

All sensitive data such as customer PINs and passwords are stored in encrypted format throughout our systems and databases. We also protect our systems and your data form external access by using multiple levels of firewalls.

Paga staff and customer service representatives cannot access your data without system authorisation. They do not have access to customer PINs or passwords and will never ask you to provide this information.

Your bank account details are not available to anyone at Paga. All customer bank account information is communicated between the banks and Paga via secure channels and using sophisticated data encryptions. Only the last four digits of any bank account number are visible to Paga staff and customer service representatives that are authorised to view this information.

Our Promise

Your cash is safe

All cash on Paga is safe at one of our partner banks. Our platform has been built with the state of the art security. Protect your username, password, and PIN, and you are safe. We will never ask you for this information.

We protect your privacy

We will never give your phone or private information to anyone unless required by law.

We will resolve all issues in 48 hours

Our team is at your service; we will do everything in our power to resolve all issues within 48 hours.

There are no hidden fees

Transparency is a core tenet of our service, our fees will always be communicated.

Paga Cards

Introduction

By using your PAGA PREPAID CARD (the “Card”), you unconditionally agree to be bound by these Terms and Conditions and any laws, rules, regulations, and official issuances applicable, now existing or which may hereinafter be enacted, issued, or enforced by the Regulator. These terms and conditions (the “Terms” or “T&C”) comprise the agreement between PAGATECH LIMITED (hereinafter referred to as “Paga”, “we”, “us” and “our”) and the CARDHOLDER (hereinafter referred to as “you” and “your”).

Definition

1.1. “Access Points” means an Automated Teller Machine (ATM), Point of Sale (POS) terminal or website merchant location where the Card is used.

1.2. “Bank” means United Bank for Africa Plc.

1.3. “Card” means prepaid cards (physical or virtual) issued by us, including any renewal or replacement Card or cards.

1.4. “Cardholder” means the person to whom the Card is issued, having power alone to operate the Card in accordance with the Terms and the rules and regulations in respect thereof.

1.5. “CBN” means the Central Bank of Nigeria.

1.6. “Customer Self-Service Online Application” means the website or mobile application that customers can access to obtain their account balance, update their details, and make card-to-card transfers.

1.7. “Regulator” means the Central Bank of Nigeria.

1.8. “Initial PIN” means the first personal identification number for the Card issued to you.

1.9. “Load” and “Reload” mean to pay/credit money to your Card.

1.10. “Paga Online Consumer Application” means. Paga website - www.mypaga.com

1.11. “Pass Code” means the 4-digit code used to access the Customer Self-Service Online Application.

1.12. “PIN” means the Personal Identification Number required to authorise transactions (ATM, POS, or WEB).

1.13. “Transaction” means any cash withdrawal or payment initiated on the Card.

Applying for a Card

2.1. You must be at least 18 years old to apply for a Card.

2.2. Proof of identity is required to apply, and we may carry out checks on you electronically.

2.3. You must provide a valid telephone number and/or e-mail at the point of applying for a Card.

2.4. All relevant Card issuance fees must be paid when applying for the Card.

Activating your Card

3.1. To activate the Card, you must provide the relevant Know Your Customer information or documentation as requested by us.

3.2. Once you activate your Card, a unique customer ID will be assigned to the Card.

3.3. You shall sign on the back of the Card once received.

3.4. Peel off the PIN tab on the fulfilment or welcome letter for the Card to reveal your initial PIN.

3.5. While you will be able to use the Initial PIN for Transactions and even retain it as your PIN if you so desire, it is advisable to change the Initial PIN to one of your choice in accordance with these Terms. You assume full responsibility for the Initial PIN and any subsequent PIN.

3.6. The Initial PIN change must be done using the UBA Plc ATM, but subsequent changes can be done on other banks' ATM. It is always advisable to change your PIN to one you can easily remember and that cannot be easily guessed by anyone.

3.7. In case you experience any difficulty using your default PIN, kindly contact the PAGA Customer Fulfilment Centre at 02013444300 or service@paga.

3.8. By using the Card, you agree to these Terms.

3.9. You agree and consent to our processing your personal information in line with the Nigerian Data Protection Regulation (NDPR) for the purpose of the issuance of the Card and your use of the Card.

Loading and Reloading

4.1. Loading and Reloading can be done by transferring using any PAGA Online Consumer Applications.

4.2. Once your Load/Reload (as the case may be), your funds will be available for use without delay.

4.3. The maximum Load amount allowed on your Card shall be determined from time to time in line with the relevant CBN Regulations. A Load/Reload Fee will apply to each Load/Reload that you make.

Using the Card

5.1. The Card shall be denominated in Naira.

5.2. You can use the Card for withdrawal of cash from cash machines (ATMs) and or to make payments for goods and or services.

5.3. You must follow any instructions that we give about using your Card and keeping it safe.

5.4. A Transaction is deemed to be authorised where it is used at any Access Point, or the Card information is supplied on any platform, and the PIN is entered.

5.5. We will assume that all Transactions initiated on your Card are authorised by you unless you inform us otherwise immediately after.

5.6. We will deduct the value of your Transaction from the balance on your Card as soon as you authorise a Transaction, as well as any applicable fees.

5.7. We will also deduct any applicable fees as soon as they become payable by you.

5.8. The Card must not be used for any unlawful transaction, including the purchase of goods and or services prohibited by the laws of the Federal Republic of Nigeria or any applicable jurisdiction

5.9. We may refuse to authorise the use of the Card if the transaction does not comply with applicable terms from time to time.

5.10. All transactions can be viewed online by accessing the customer self-service application with your Pass Code.

5.11. You may initiate international Transactions with your Card, subject to the United States Dollars spend limit on your Card.

5.12. Where you use the Card to make payment for an item denominated in foreign currency, we will convert your payment into United States Dollars using the prevailing exchange rate, which exchange rate shall vary from time to time.

5.13. We may at any time suspend, restrict, or cancel your Card or refuse to issue or replace a Card for reasons relating to the following::

5.13.1. We are concerned about the security of the Card we have issued to you.

5.13.2. We suspect your Card is being used in an unauthorised or fraudulent manner.

5.13.3. We need to do so to comply with the law;

5.13.4. We consider it necessary to so act;

5.13.5. We notice that you have registered multiple Cards against your Paga wallet, which exceeds the allowed limit.

5.13.6. If we do this, we will tell you as soon as we can or are permitted to do so after we have taken these steps, and we shall not be liable to refund the card issuance fee.

5.14. We may also refuse to support a transaction::

5.14.1. if we are concerned with the security of your Card or suspect your Card is being used in an unauthorised or fraudulent manner;

5.14.2. where the value of the transaction exceeds your daily spend limit;

5.14.3. where the transaction originates from a blacklisted merchant;

5.14.4. where sufficient funds are not loaded on your Card at the time of a transaction to cover the amount of the transaction and any applicable fees;

5.14.5. where there is an outstanding shortfall on the Card;

5.14.6. where we have reasonable grounds to believe that you are acting in breach of these Terms;

5.14.7. where we have reasonable grounds to believe that a third party may have rights over the amount on your Card;

5.14.8. In compliance with a court order issued by a Nigerian Court of competent jurisdiction;

5.14.9. where we believe that a transaction is potentially suspicious or illegal (for example, if we believe that a transaction is being made fraudulently);

5.14.10. or because of errors, failures (whether mechanical or otherwise) or refusals by merchants, payment processors or payment schemes processing transactions;

5.14.11. If we refuse to authorise a transaction, we will, if practicable, tell you why immediately unless it would be unlawful for us to do so. You may correct any information we hold which may have caused us to refuse a transaction.

5.14.12. where it is impracticable or unlawful for us to do so.

5.15. Once you authorise a Transaction, it cannot be revoked or withdrawn.

5.16. You shall be required to provide such information as we may deem fit for our due diligence or Know Your Customer processes to enable you to continue to use the Card.

5.17. We shall maintain records of your Transactions for at least five (5) years after completion of the Transaction or such longer period as may be required by the Central Bank of Nigeria (“CBN”).

5.18. We will use reasonable efforts to support transactions initiated on the Card, but do not guarantee that we will always be able to receive or support transactions.

5.19. Access to the internet or mobile data is necessary to manage the Card, check your fund balance and available funds on the Card.

5.20. You must keep your Card safe and not let anyone else use it.

If you are issued a PIN, you must always keep it confidential. You should memorise the PIN, destroy the notification for the Initial PIN and never disclose the PIN or security information to anyone. If you suspect that someone else knows your PIN, you should change it as soon as possible. You can change your PIN to something more memorable at most ATMs by following the on-screen instructions. Please do not interfere with any magnetic stripe or integrated circuit (chip) in the card.

We recommend that you check the balance on your card regularly online at the Customer Self-Service Online Application with your Pass Code. We will provide you with your Card balance and a statement of recent Transactions either by electronic means or on our secure mobile app at any time. Your statement will show: Your statement will show::

5.20.1. Information relating to each Card transaction which will enable it to be identified.

5.20.2. The amount of the Card transaction is shown in the currency in which the transaction was paid or debited to the Card.

5.20.3. The amount of any applicable charges for the Transaction;

5.20.4. The date the Transaction is authorised or posted onto the Card.

Expiration of the Card

6.1. The Card will detail an expiration date.

6.2. We reserve the right to issue a new Card upon the expiration of the old one. The new Card will expire on the last day of the month indicated on its expiration date, and these T&CS will continue to apply. You will be informed prior to expiration to allow you to request a new Card. If you are unable to secure a new Card before the current one expires, your balances will be refunded to your Paga wallet.

Fees and Charges

7.1. You shall be charged fees in accordance with the schedule of fees and charges regarding your Card.

7.2. For any queries, complaints, or issues regarding your Card, you are encouraged to call our Customer Support Centre as outlined in these Terms.

Additional Provisions on Fees & Charges

8.1. Paga reserves the right to amend the Declined Transaction Fee and other applicable fees, with prior notice to Cardholders.

Limiting your right to use the Card

9.1. If we have a good reason, we may::

9.1.1. Refuse to approve a transaction; or

9.1.2. Cancel or suspend your right to use the Card for any or all purposes, or refuse to replace the Card, without prior notice to you.

9.2. These Terms and Conditions shall continue to apply even if any of the actions above are taken.

Security

10.1. You should always keep the Card carefully and your PIN confidential. Keep the Card separate from any cheques.

10.2. Never write down or record your PIN.

10.3. Only reveal the Card number to make a transaction or to report the loss or theft of the Card. For the latter, we will not require your full PAN details but will request sufficient information to identify your account.

10.4. The PIN may be used for cash withdrawals, balance inquiries at ATMs, and for making payments at some merchant terminals.

10.5. Use of the wrong PIN three (3) times will invalidate the Card. Paga bears no liability for unauthorised use of the Card. You are responsible for keeping the Card safe and your PIN confidential.

Notification

11.1. What you should notify us of:

11.1.1. Immediately, your Card is lost or stolen, or you think that the Card may be compromised, misused or if the PIN is disclosed to any unauthorised persons or suspected of having been compromised.

11.1.2. Immediately, if your statement includes an item that you think is wrong, and

11.1.3. Immediately, you change your name, address, phone number or email address. If we contact you in relation to your Card, for example, to notify you that we have cancelled your Card or to send you a refund by cheque, we will use the most recent contact details you have provided to us. Any email to you will be treated as being received as soon as it is sent by us. We will not be liable to you if your contact details have changed, and you have not told us.

Loss or Misuse of your Card

12.1. Your Liabilities

12.1.1. If your Card is lost, stolen, or misused by someone who obtained it without your permission, you will be liable for all amounts transacted on your Card and losses incurred.

12.1.2. If it is misused with your permission, you will be liable for all losses.

12.1.3. If the Card has been fraudulently used before you report the loss, or in a manner that suggests compromise by the cardholder, you will be liable for all losses incurred.

12.1.4. Paga shall not be liable for consequences that arise from any transaction because of disclosure to any third party.

12.1.5. Paga shall not be liable, accountable, or responsible in any way whatsoever to the Cardholder for any loss, injury or damage however arising out of the use of the Access Points.

12.1.6. If the Card is lost or stolen, or is misused, or someone else may have discovered the PIN, you must notify us immediately by calling or emailing us on our Customer Fulfilment Centre telephone number and email address in these Terms. Upon receipt of your report, we will take reasonable steps to stop the use of the Card.

12.2. You must cooperate with the police and us in our efforts to recover the Card. If you recover it, you must not use it but should destroy the Card by cutting it in half.

You must report any loss or theft of the Card to the police, and if we request it, obtain a crime reference number.

Limits of Liability

13.1. Until you notify us in writing that your Card is lost, stolen, or at risk of being misused, you will be liable for transactions before we acknowledge receipt of the notification.

13.2. If someone uses the Card issued to you, you will be liable for all transactions which take place prior to your written notification to us.

13.3. You will not be liable for losses from transactions that occur after you have notified us in writing, and we have acknowledged receipt of your notification that your Card is lost, stolen, or at risk of misuse.

13.4. If we are unable to debit your Card because it has been closed or due to any other reason beyond our control, you will still be liable to pay us for all transactions.

13.5. We will not be liable to you if we cannot carry out our responsibilities under these Terms due to events outside of our reasonable control, including but not limited to:

13.5.1. any machine failure or technical glitches;

13.5.2. compliance with applicable laws, guidelines, and regulations; and

13.5.3. industrial disputes, natural disasters, pandemics (excluding Covid-19), epidemics, or acts of God.

13.6. We will only be responsible for the loss you suffer as a direct result of our gross negligence, up to a maximum of the balance on your Card.

13.7. We shall not be liable for any indirect, consequential, or incidental loss or damage (e.g., loss of reputation, revenue, or opportunity, etc).

13.8. If you do not use your Card in accordance with these Terms, or if the Card is used fraudulently, we reserve the right to charge you for any reasonable costs incurred in taking action to stop its use and recover any monies due to your activities.

13.9. We shall not be liable for the goods or services purchased with your Card.

13.10. We shall not be liable for a merchant's refusal to honour a transaction on your Card or failure to cancel an authorisation.

13.11. You understand that there may be interruptions in the use of your Card, e.g., when maintenance is being carried out, which we will not be held liable for. During this short period, you may be unable to use your Card to pay for purchases or withdraw cash from the ATM, reload your Card, or check the balance on the Card.

Refunds and Claims

14.1. We will credit your Card with a refund for any transaction or incorrect debit to your Card that you have protested, only after an independent investigation is conducted by us and we are satisfied that your claims are correct. You cannot use a claim you may have against someone else to make a claim against us or refuse to pay us unless you have a legal right to do so. You cannot transfer any rights against us to anyone else.

14.2. If you have any disputes about purchases made using your Card, you should settle these with the person you bought the goods or services from. We are not responsible for the quality, safety, legality, or any other aspect of any goods or services purchased with your Card. Remember that once you have used your Card to make a purchase, we cannot stop that transaction.

Terminating the Terms

15.1. The Terms will come to an end following the expiration of the Card and you fail to obtain a new Card.

15.2. We reserve the right to terminate these Terms effective immediately where;

15.2.1. you breach any of the Terms of this T&C.

15.2.2. you act in a manner that negatively impacts our business or you threaten or make derogatory comments to our employees.

15.2.3. you fail to pay any fee or amounts due under these Terms.

15.3. We may terminate our relationship with you under these Terms at any time, by giving thirty (30) days prior written notice to you.

15.4. You may terminate these Terms by contacting us via the Customer Fulfilment Centre (CFC) via any of the means detailed in these Terms.

15.5. Upon termination taking effect, we will cancel the Card and the Cardholder upon written request, shall be entitled to receive any refund on the balance on the Card, if any, subject to the deduction of any outstanding fees or charges due on the Card.

General

16.1. We do not warrant that the services and benefits that we provide pursuant to the Terms will always be available. We reserve the right to withdraw or vary these services or benefits at any time without giving you notice.

16.2. We will charge you for any loss or cost we incur resulting from a breach of the Terms by you.

16.3. The Terms are governed by the Laws of the Federal Republic of Nigeria, including laws pertaining to money laundering, CBN regulations, guidelines, and other applicable laws in Nigeria.

16.4. Your application for a card will be subject to our processes and reviews, which may require you to provide further confirmation on documents. We reserve the right to accept or reject your application.

16.5. We reserve the right to terminate the Terms immediately upon suspicion of false information on opening a prepaid card or a fraudulent/criminal act being ascertained against you.

Governing Law and Dispute Resolution

These terms and conditions shall be construed in accordance with Nigerian Law, and the courts in Lagos, Nigeria, shall have jurisdiction to settle any issues or matters arising from these Terms.

Amendments & Updates