Paga US

Terms of Service

Introduction

The following terms constitute a legal agreement (the “Agreement”) between you (“you”, or “your”) and Apposit LLC d/b/a Paga and its successors and assigns (“Paga”, “we”, “us”, or “our”) that sets forth the terms and conditions for your use of the products and services offered, operated or made available by Paga through websites or mobile applications (collectively, the “Paga App”) owned and operated by Paga and its affiliates (the “Services”). The Services are being provided to you expressly subject to this Agreement. By accessing and/or using the Services on behalf of yourself or the entity that you represent, you acknowledge that you have read, understood, and agree to be bound by the terms of this Agreement and to comply with all applicable laws and regulations. The terms and conditions of this Agreement form an essential basis of the bargain between you and Paga, and this Agreement governs your use of the Services.

THIS AGREEMENT ALSO INCLUDES, AMONG OTHER THINGS, A BINDING ARBITRATION PROVISION THAT CONTAINS A CLASS ACTION WAIVER. IT WILL HAVE A SUBSTANTIAL EFFECT ON YOUR RIGHTS IN THE EVENT OF A DISPUTE UNLESS YOU OPT OUT IN ACCORDANCE WITH SECTION 15(c). PLEASE REFER TO SECTION 15 BELOW ENTITLED “DISPUTE RESOLUTION BY BINDING ARBITRATION” FOR MORE INFORMATION.

Acceptance of this Agreement

Please carefully review this Agreement before using the Services. If you do not agree to these terms, you may not access or use the Services. By installing the Paga App, accessing or using the Services and by accepting this Agreement electronically (for example, clicking “I Agree”), you agree to be bound by this Agreement, as this Agreement is updated from time to time by us. If you do not agree to this Agreement, then you may not use the Services. Your use of the Services is subject to the additional disclaimers and notices that may appear throughout the Services.

Enrollment for Paga’s Services

Through the Services, you may open and access financial accounts and services offered by our partners. In order to enroll in the Services, you will need to sign up for an account through the Paga App (an “Account”). This process may include creation of a login ID and password to access the Services.

You authorize us to make any inquiries we consider necessary to validate your identity, including, if requested, your name, address, date of birth, government issued identification, social security number and/or requiring you to take steps to confirm ownership of your email address and mobile phone number, or verifying information you provide against third-party databases or through other sources. If you do not provide this information or Paga cannot verify your identity, we can refuse to allow you to use the Services.

You further represent that you are a legal owner of, and that you are authorized to provide us with, the information you provide to us to validate your identity and contact you. You shall ensure that any such information is up-to-date, accurate, and complete. If any of that information changes (including your e-mail address or mobile phone number), you will update that information on the Paga App as soon as possible. Should you believe or have reason to believe that any information you provide to us or your login credentials for your account with us has been compromised, or that another person is accessing your account through some other means, you agree to notify us as soon as possible at help@paga.com.

Eligibility

In order to use the Services, you must be an individual of at least 18 years of age, have a United States of America social security number or Individual Taxpayer Identification Number, or have a Nigerian National Identification Number, and a valid mobile number. The Services may not be appropriate or available for use in some non-U.S. jurisdictions. Any use of the Services is at your own risk. We may limit the Services’ availability at any time, in whole or in part, to any person, geographic area, or jurisdiction that we choose. Your right to access and use the Services is personal to you and is not transferable by you to any other person or entity. You may not create more than one account with Paga.

Personal and Noncommercial Use Limitation: Prohibited Uses

You agree to use the Services only for lawful purposes. You are prohibited from any use of the Services that would constitute a violation of any applicable law, regulation, rule or ordinance of any nationality, state, or locality or of any international law or treaty, or that could give rise to any civil or criminal liability. Any unauthorized use of the Services, including but not limited to unauthorized entry into Paga’s systems, misuse of passwords, or misuse of any information posted on through the Services is strictly prohibited.

We grant you access to the Paga App during the term of this Agreement solely to receive the Services. You may access, download, and print materials as necessary to receive the Services. You may not license, copy, distribute, create derivative works from, frame in another Website page, use on any other website, or sell any information, databases, or lists obtained from the Services. You agree to provide true, accurate, and complete user information at all times, and to update such information upon our request. You will not access or attempt to access password protected, secure or non-public areas of the Services, without our prior written permission. You will comply with all privacy laws.

The Services are licensed (not sold) to end users. Subject to this Agreement, we grant to you a personal, non-exclusive, non-transferable, limited, and revocable license to access the Services for your own personal use and not for any commercial or business purpose.

As a condition of your use of the Services, you warrant to Paga that you will not use the Services for any purpose that is against the law or prohibited by this Agreement. If you violate this Agreement, you may be prohibited from using the Services.

You agree you will not (1) try to reverse engineer, disassemble, decompile, or decipher the Services or software making up the Services, (2) use a means other than Paga’s provided interface to access the Services, (4) use the Services in a way that could impair, overburden, damage, or disable any portion of the Services, or (5) mirror any material contained on the Services. You may not without our prior written permission use any computer code, data mining software, “robot,” “bot,” “spider,” “scraper,” or other automatic device, or program, algorithm or methodology having similar processes or functionality, or any manual process, to monitor or copy any of the Website pages, data, or content found on the Services, or accessed through the Services. You may not republish Paga content or other content from the Services, on another website or app or use in-line or other linking to display such content without our permission. You may not introduce viruses, spyware, or other malicious code to the Services. You represent and warrant that you use frequently updated, commercially standard virus protection software to ensure that the system you use to access the Paga App is virus free.

You will not attempt to gain unauthorized access to any other user’s account. You will not modify or attempt to modify or in any way tamper with, circumvent, disable, damage or otherwise interfere with the Services. You will not modify, adapt, translate or create derivative works based upon the Services or any part thereof, except and only to the extent the foregoing restriction is expressly prohibited by applicable law, or copy, distribute, transfer, sell or license all or part of the Services. You will not use the Services to access, copy, transfer, retransmit or transcode information, Paga logos, marks, names or designs or any other content in violation of any law or third-party rights, or remove, obscure, or alter Paga’s (or any third-party’s) copyright notices, trademarks, or other proprietary rights notices affixed to or contained within or accessed through the Services. You will not use the Service (including the chat feature) to transmit or disseminate any: junk mail, spam, or unsolicited material to persons who have not agreed to receive such material or to whom you do not otherwise have a legal right to send such material; material that infringes or violates any third-party’s intellectual property rights, rights of publicity, privacy, or confidentiality, or the rights or legal obligations of any wireless service provider or any of its customers or subscribers; material or data that is illegal, harassing, coercive, defamatory, libelous, abusive, threatening, obscene, or otherwise objectionable, materials that are harmful to minors or excessive in quantity, or the transmission of material in which could diminish or harm our reputation or any third-party service providing SMS messaging services; material or data that is alcoholic beverage-related (e.g., beer, wine, or liquor), tobacco-related (e.g., cigarettes, cigars, pipes, chewing tobacco and vaping products), guns or weapons-related (e.g., firearms, bullets), illegal drugs-related (e.g., marijuana, cocaine), pornographic-related (e.g., adult themes, sexual content), crime-related (e.g., organized crime, notorious characters), violence-related (e.g., violent games), death-related (e.g., funeral homes, mortuaries), hate-related (e.g. racist organizations), gambling-related (e.g., casinos, lotteries), specifically mentions any wireless carrier or copies or parodies the products or services of any wireless carrier; viruses, Trojan horses, worms, time bombs, cancelbots, or other computer programming routines that are intended to damage, detrimentally interfere with, surreptitiously intercept or expropriate any system, data, or personal information; material that would expose us or any third-party service in providing the Service to liability; any signal or impulse that could cause electrical, magnetic, optical, or other technical harm to the equipment or facilities of Paga or any third-party. You agree that you will not attempt to: (a) access any software or services for which your use has not been authorized; or (b) use or attempt to use a third-party’s account; or (c) interfere in any manner with the provision of the Services, the security of the Services, or other customers of the Services; or (d) otherwise abuse the Services.

Paga reserves the right to take various actions against you if we believe you have engaged in activities restricted by this Agreement or by laws or regulations, and Paga also reserves the right to take action to protect Paga, other users, and other third parties from any liability, fees, fines, or penalties. We make take actions including, but not limited to: (1) updating information you have provided to us so that it is accurate, (2) limiting or completely closing your access to the Services, (3) suspending or terminating your ability to use the Services on an ongoing basis, (4) taking legal action against you, and (5) holding you liable for the amount of Paga’s damages caused by your violation of this Agreement.

Third-Party Service Terms

We may, from time-to-time and subject to this Agreement, make a third-party’s products and services available to you through the Services (the “Third-Party Services”). The Services may provide Third-Party Service listings, descriptions, and images of goods or services or related coupons or discounts, as well as references and links to such Third-Party Service. Such Services may include a deposit account through our banking partner, Regent Bank, Member FDIC, as well as Third-Party Services provided by Elta Limited and other parties facilitating payment collection, or foreign currency conversion for the purpose of making deposits to a Regent Bank account. These Third-Party Services are governed by the terms of the agreement between you and the third-party offering the Third-Party Services, and may be subject to additional eligibility criteria beyond what is required to open your Paga Account.

We do not control or endorse, nor are we responsible for, any Third-Party Service, including the accuracy, validity, timeliness, completeness, reliability, integrity, quality, legality, usefulness, or safety of any Third-Party Service, or any intellectual property rights in any Third-Party Service. Nothing in this Agreement shall be deemed to be a representation or warranty by us with respect to any Third-Party Service. We have no obligation to monitor Third-Party Services, and we may block or disable access to any Third-Party Services through the Services at any time. In addition, the availability of any Third-Party Services through the Services does not imply our endorsement of, or our affiliation with, any provider of such Third-Party Service, nor does such availability create any legal relationship between you and any such provider. YOUR USE OF ANY THIRD-PARTY SERVICE IS AT YOUR OWN RISK AND IS SUBJECT TO ANY ADDITIONAL TERMS, CONDITIONS AND POLICIES APPLICABLE TO SUCH THIRD-PARTY SERVICE (SUCH AS TERMS OF SERVICE OR PRIVACY POLICIES OF THE PROVIDERS OF SUCH THIRD-PARTY SERVICES).

Links to Third-Party Sites

The Services may contain hyperlinks to websites or applications operated by parties other than Paga. Such hyperlinks are provided for your reference only. We do not control such websites or applications and are not responsible for their content. Your access to and use of such websites or applications, including information, material, products and services on such websites or applications, is solely at your own risk. Furthermore, because our Privacy Policy is applicable only when you are on the Services, once linked to another website or application, you should read that site’s privacy policy before disclosing any personal information.

Disclaimer of Warranties

THE SERVICES ARE PROVIDED ON AN “AS IS” AND “AS AVAILABLE” BASIS. TO THE FULLEST EXTENT PERMITTED BY LAW, PAGA AND ALL OF ITS SUCCESSORS, PARENTS, SUBSIDIARIES, AFFILIATES, OFFICERS, DIRECTORS, STOCKHOLDERS, INVESTORS, EMPLOYEES, AGENTS, REPRESENTATIVES AND ATTORNEYS AND THEIR RESPECTIVE HEIRS, SUCCESSORS, AND ASSIGNS (COLLECTIVELY, THE “PAGA PARTIES”) EXPRESSLY MAKE NO REPRESENTATIONS OR WARRANTIES OF ANY KIND, EXPRESS, STATUTORY, OR IMPLIED AS TO THE CONTENT OR OPERATION OF THE SERVICES. YOU EXPRESSLY AGREE THAT YOUR USE OF THE SERVICES IS AT YOUR SOLE RISK. IF YOU ARE A CALIFORNIA RESIDENT, YOU HEREBY WAIVE CALIFORNIA CIVIL CODE SECTION 1542 WHICH PROVIDES: “A GENERAL RELEASE DOES NOT EXTEND TO CLAIMS THAT THE CREDITOR OR RELEASING PARTY DOES NOT KNOW OR SUSPECT TO EXIST IN HIS OR HER FAVOR AT THE TIME OF EXECUTING THE RELEASE AND THAT, IF KNOWN BY HIM OR HER, WOULD HAVE MATERIALLY AFFECTED HIS OR HER SETTLEMENT WITH THE DEBTOR OR RELEASED PARTY.”

THE PAGA PARTIES MAKE NO REPRESENTATIONS, WARRANTIES OR GUARANTEES, EXPRESS OR IMPLIED, REGARDING THE ACCURACY, ADEQUACY, TIMELINESS, RELIABILITY, COMPLETENESS, OR USEFULNESS OF ANY OF THE INFORMATION OR CONTENT ON THE SERVICES, AND EXPRESSLY DISCLAIM ANY WARRANTIES OF MERCHANTABILITY, FITNESS FOR A PARTICULAR PURPOSE, NON-INFRINGEMENT, OR TITLE. THE PAGA PARTIES MAKE NO REPRESENTATION, WARRANTY, OR GUARANTEE THAT THE SERVICES ARE FREE OF VIRUSES, BUGS, DEFECTS, ERRORS, OR OTHER COMPUTING ROUTINES THAT CONTAIN DAMAGING OR OTHERWISE CONTAMINATING PROPERTIES, OR PROGRAMS INTENDED TO INTERCEPT OR STEAL PERSONAL OR SYSTEM DATA.

Please note, the ability to exclude warranties varies in different jurisdictions. To the extent that a jurisdiction places limits on the ability for a party to exclude warranties, these exclusions exist to the extent permitted by law. Because of this jurisdictional variance, some of the above exclusions may not apply to you.

Your access and use of the Services may be interrupted from time to time for any of several reasons, including, without limitation, the malfunction of equipment, periodic updating, maintenance or repair of the Services or other actions that Paga, in its sole discretion, may elect to take. In no event will Paga be liable to any party for any loss, cost, or damage that results from any scheduled or unscheduled downtime.

Your sole and exclusive remedy for any failure or non-performance of the Services, including any associated software or other materials supplied in connection with such Services, shall be for Paga to use commercially reasonable efforts to effectuate an adjustment or repair of the applicable Services.

Limitation of Liability

YOU EXPRESSLY UNDERSTAND AND AGREE THAT PAGA SHALL NOT BE LIABLE FOR ANY DIRECT, INDIRECT, INCIDENTAL, SPECIAL, CONSEQUENTIAL, OR EXEMPLARY DAMAGES, INCLUDING BUT NOT LIMITED TO, DAMAGES FOR LOSS OF PROFITS, GOODWILL, USE, DATA, OR OTHER INTANGIBLE LOSSES (EVEN IF ADVISED OF THE POSSIBILITY OF SUCH DAMAGES), RESULTING FROM: (i) THE USE OR THE INABILITY TO USE THE SERVICES; (ii) THE AVAILABILITY OF TELECOMMUNICATION SERVICES FROM YOUR PROVIDER AND ACCESS TO THE SERVICES AT ANY TIME OR FROM ANY LOCATION; (iii) THE COST OF SUBSTITUTE SERVICES RESULTING FROM ANY DATA, INFORMATION, OR SERVICES OBTAINED OR MESSAGES RECEIVED OR TRANSACTIONS ENTERED INTO THROUGH OR FROM THE SERVICES; (iv) UNAUTHORIZED ACCESS TO OR ALTERATION OF YOUR TRANSMISSIONS OR DATA; (v) STATEMENTS OR CONDUCT OF ANY THIRD-PARTY; OR (vi) ANY OTHER MATTER RELATING TO SERVICES. IN NO EVENT WILL OUR MAXIMUM LIABILITY TO YOU EXCEED THE GREATER OF (1) THE AMOUNT THAT YOU HAVE PAID TO PAGA IN THE TWELVE MONTH PERIOD PRECEDING THE EVENT GIVING RISE TO THE APPLICABLE CLAIM; OR (2) $100 (ONE HUNDRED DOLLARS).

SOME JURISDICTIONS DO NOT ALLOW THE EXCLUSION OF CERTAIN WARRANTIES OR THE LIMITATION OR EXCLUSION OF LIABILITY FOR INCIDENTAL OR CONSEQUENTIAL DAMAGES. IN SUCH STATES LIABILITY IS LIMITED TO THE EXTENT PERMITTED BY LAW. ACCORDINGLY, SOME OF THE ABOVE LIMITATIONS OF WARRANTIES OR LIABILITY MAY NOT APPLY TO YOU.

Indemnification

To the fullest extent permitted by law, you agree to indemnify, defend and hold harmless the Paga Parties from and against any and all claims, losses, expenses, demands or liabilities, including reasonable attorneys’ fees arising out of or relating to (i) your access to, use of or alleged use of the Services; (ii) your violation of this Agreement or any representation, warranty, or agreements referenced herein, or any applicable law or regulation; (iii) your violation of any third-party right, including without limitation any intellectual property right, publicity, confidentiality, property or privacy right; or (iv) any disputes or issues between you and any third-party, including without limitation, your employer. We reserve the right, at our own expense, to assume the exclusive defense and control of any matter otherwise subject to indemnification by you, and in such case, you agree to cooperate with our defense of such claim. You will cooperate as fully as reasonably required in the defense of any such claim. Paga reserves the right, at its own expense, to assume the exclusive defense and control of any matter subject to indemnification by you. You agree not to settle any matter without the prior written consent of Paga.

Application License

If you access the Services via the Paga App, then we grant you a revocable, non-exclusive, non-transferable, limited right to install and use the Paga App, on wireless electronic devices owned or controlled by you, and to access and use the Paga App, on such devices strictly in accordance with the terms and conditions of this Paga App license contained in this Agreement. The following terms apply when you use a Paga App obtained from either the Paga Apple Store or Google Play (each an “App Distributor”) to access the Services: (1) the license granted to you for our Paga App is limited to a non-transferable license to use the Paga App on a device that utilizes the Apple iOS or Android operating systems, as applicable, and in accordance with the usage rules set forth in the applicable App Distributor’s terms of service; (2) we are responsible for providing any maintenance and support services with respect to the Paga App as specified in the terms and conditions of this Paga App license contained in this Agreement or as otherwise required under applicable law, and you acknowledge that each App Distributor has no obligation whatsoever to furnish any maintenance and support services with respect to the Paga App; (3) in the event of any failure of the Paga App to conform to any applicable warranty, you may notify the applicable App Distributor; (4) you represent and warrant that (i) you are not located in a country that is subject to a U.S. government embargo, or that has been designated by the U.S. government as a “terrorist supporting” country and (ii) you are not listed on any U.S. government list of prohibited or restricted parties; (5) you must comply with applicable third-party terms of agreement when using the Paga App, e.g., if you have a VoIP application, then you must not be in violation of their wireless data service agreement when using the Paga App; and (6) you acknowledge and agree that the App Distributors are third-party beneficiaries of the terms and conditions in this Paga App license contained in this Agreement, and that each App Distributor will have the right (and will be deemed to have accepted the right) to enforce the terms and conditions in this Paga App license contained in this Agreement against you as a third-party beneficiary thereof. Apple and Google are not sponsors of any content or Services.

Phone Communication & Push Notifications

When you provide us with your mobile phone number, you agree that Paga and its affiliates may contact you at that number using text messages with service-related information such as alerts and transactional messages, or questions about the Services or your Account. We will not use autodialed or prerecorded SMS or texts to contact you for marketing or promotional purposes unless we receive your prior express written consent. You do not have to agree to receive marketing-related, autodialed or prerecorded SMS or texts in order to use the Services. If you choose to receive marketing-related prerecorded SMS or texts via long code, you can later opt-out of such marketing-related messages by contacting us. Standard text charges may apply to all SMS or text messages. If you have any questions about your text plan or data plan, it is best to contact your wireless provider. Carriers are not liable for delayed or undelivered messages.

You certify, warrant and represent that the telephone number you have provided to us is your contact number and not someone else’s. You represent that you are permitted to receive text messages at the telephone number you have provided to us. You agree to promptly alert us whenever you stop using a telephone number.

You can cancel the SMS service at any time. Just text “STOP” to the short code. After you send the SMS message “STOP” to us, we will send you an SMS message to confirm that you have been unsubscribed. After this, you will no longer receive SMS messages from us. If you want to join again, just sign up as you did the first time and we will start sending SMS messages to you again.

We may modify or terminate our SMS messaging services from time to time, for any reason, and without notice, including the right to terminate SMS messaging with or without notice, without liability to you.

You agree to receive push notifications from us. You can opt out of receiving push notifications through your device settings. Please note that opting out of receiving push notifications may impact your use of the Services.

Changes to the Services and Agreement

We may make improvements or changes in the information, services, products, and other materials through the Services or terminate the Services at any time. We may modify this Agreement at any time, and such modifications will be effective immediately upon posting of the modified Agreement. Accordingly, you agree to review the Agreement periodically, and your continued access or use of the Services will be deemed your acceptance of the modified Agreement.

Termination; Survival

This Agreement will continue to apply until terminated by either you or us. If you desire to terminate this Agreement, contact us at [CONTACT INFO]. If this Agreement is terminated, we will have no further obligation to provide or allow access to your Account or the Services.

We may terminate this Agreement and your access to the Services at any time, for any reason or no reason, upon notice to you, to the e-mail address provided by you as part of your enrollment for your account with us. You acknowledge and agree that Paga may immediately deactivate or delete your account and all related information and files in your account and/or prohibit any further access to all files and the Services by you. Further, you agree that Paga shall not be liable to you or any third-party for any termination of your access to the Services. Further, you acknowledge and agree that Paga may retain information about your account, in accordance with Paga’s privacy policy and subject to applicable law, even once you have closed your account.

The following provisions of this Agreement will survive termination of your use or access to the Services: the sections concerning Indemnification, Disclaimer of Warranties, Limitation of Liability, Waiver, Dispute Resolution by Binding Arbitration, and Miscellaneous, and any other provision that by its terms survives termination of your use or access to the Services. For clarity, termination of this Agreement does not affect your obligations or our rights under any agreement between you and Paga.

DISPUTE RESOLUTION BY BINDING ARBITRATION

PLEASE READ THIS SECTION CAREFULLY AS IT AFFECTS YOUR RIGHTS AND INCLUDES, AMONG OTHER THINGS, A CLASS ACTION WAIVER. YOU ACKNOWLEDGE THAT YOU HAVE READ THIS SECTION (THE "ARBITRATION PROVISION") AND UNDERSTAND THAT THESE PROVISIONS REQUIRE YOU AND PAGA TO ARBITRATE CLAIMS ON AN INDIVIDUAL BASIS. YOU UNDERSTAND THAT YOU HAVE THE RIGHT TO REJECT THIS ARBITRATION PROVISION AS PROVIDED BELOW.

As used in this Arbitration Provision, "Claim" includes any past, present, or future claim dispute, or controversy involving you andPagathat relates to, or arises out of, this Agreement or the activities or relationships that involve, lead to, or result from this Agreement, including the validity or enforceability of any part of this Arbitration Provision or this Agreement.

Informal Dispute Resolution.

If a Claim arises, before filing any Claim in arbitration, you and Paga each agree to try and resolve the Claim informally. You will notify Paga of your Claim by live chatting with the Paga team through the Paga App and if Paga has a Claim, they will undertake reasonable efforts to contact you at the email address identified in the Account Settings tab of your Paga App to resolve the Claim. If a Claim is not resolved within 30 days after the Claim is first raised, you or Paga may initiate an arbitration proceeding as described in this Arbitration Provision.

Election to Arbitrate.

You and Paga agree that the sole and exclusive process for resolving a Claim that remains unresolved after 30 days will be final and binding individual arbitration pursuant to this Arbitration Provision, unless (1) you opt out of arbitration as described below, or (2) the Claim is subject to an explicit exception included in this Arbitration Provision. You and Paga each agree that the scope of this Arbitration Provision is to be given the broadest possible interpretation that is enforceable.

Exceptions.

Both you and Paga retain the right to bring (i) an individual Claim in small claims court if permissible in the relevant jurisdiction; or (ii) a Claim seeking injunctive or other equitable relief in court to prevent the actual or threatened violation of a party’s intellectual property rights.

Jurisdiction; Venue.

Except as otherwise required by applicable law, and for any Claims not subject to arbitration, the exclusive jurisdiction and venue for any Claims will be the state and federal courts located in New Castle County, and you and Paga consent to the personal and exclusive jurisdiction of, and venue in, such courts. Unless the arbitrator determinates that an in-person hearing is necessary or you and Paga otherwise agree, the arbitration may be conducted in via videoconference, telephonically or via other remote electronic means. If your Dispute does not exceed $10,000 not inclusive of attorneys’ fees and interest, then the arbitration will be conducted solely on the basis of the documents that you and Paga submit to the arbitrator, unless the arbitrator determines that a videoconference, telephonic or in-person hearing is necessary. If your Dispute exceeds $10,000, your right to a hearing will be determined by the JAMS Rules. Subject to such rules, the arbitrator will have the discretion to direct a reasonable exchange of information by the parties, consistent with the expedited nature of the arbitration.

Arbitration Opt-Out; Waivers.

You may opt out of this Arbitration Provision by sending an arbitration opt-out notice to help@paga.com or by regular mail to Paga, 1207 Delaware Ave #2352 Wilmington, DE 19806. To be effective, you must send your arbitration opt-out notice (the “Arbitration Opt-Out Notice”) within 30 days after you accept the terms of this Agreement or within 30 days after we provide notice to you of any update to this Arbitration Provision. This Arbitration Provision will remain in effect unless and until we receive the Arbitration Opt-Out Notice within the applicable 30-day period. The opt out notice must clearly state that you are rejecting arbitration and include your name, address, and signature. UNLESS YOU PROVIDE PAGA WITH AN ARBITRATION OPT-OUT NOTICE WITHIN THE APPLICABLE 30-DAY PERIOD, YOU ARE KNOWINGLY AND VOLUNTARILY WAIVING YOUR RIGHT TO LITIGATE CLAIMS IN COURT. IN ADDITION, YOU AND PAGA AGREE TO WAIVE THE RIGHT TO A JURY TRIAL.

No Class Actions.

TO THE MAXIMUM EXTENT PERMITTED BY APPLICABLE LAW, YOU AND WE AGREE THAT YOU AND WE MAY BRING CLAIMS AGAINST EACH OTHER ONLY IN AN INDIVIDUAL CAPACITY, AND NOT AS A PLAINTIFF OR CLASS MEMBER IN ANY PURPORTED CLASS OR REPRESENTATIVE PROCEEDING.

Arbitration Rules and Process.

The party initiating arbitration shall do so with Judicial Alternatives and Mediation Services (“JAMS”). Claims shall be subject to following applicable sets of rules (the “JAMS Rules”) (1) the JAMS Mass Arbitration Procedures and Guidelines, for Claims involving more than 75 consumers, represented by the same, related, or coordinate attorney or law firm (a “Mass Arbitration”); (2) JAMS’ most current version of the Streamlined Arbitration Rules, for Claims involving claims and counterclaims with an amount in controversy under $250,000, not inclusive of attorneys’ fees and interest; and (3) JAMS’s most current version of the Comprehensive Arbitration Rules and Procedures, for all other Claims. If you have any questions concerning JAMS or would like to obtain a copy of the JAMS Rules, you may call 1(800) 352-5267 or visit their web site at: www.jamsadr.com. In the case of a conflict between the JAMS Rules and this Arbitration Provision, this Arbitration Provision shall control, subject to countervailing law, unless all parties to the arbitration consent to have the JAMS Rules apply. A party who desires to initiate arbitration must provide the other party with a written Demand for Arbitration as specified in the JAMS Rules. Arbitration will proceed on an individual basis and will be handled by a sole arbitrator. The single arbitrator will be either a retired judge or an attorney licensed to practice law and will be selected by the parties from JAMS’ roster of arbitrators. If the parties are unable to agree upon an arbitrator within fourteen (14) days of delivery of the Demand for Arbitration, then JAMS will appoint the arbitrator in accordance with the JAMS Rules. The arbitrator(s) shall be authorized to award any remedies, including public injunctive relief, that would be available to you in an individual lawsuit and that are not waivable under applicable law.

Notwithstanding any language to the contrary in this section, if a party seeks injunctive relief that would significantly impact other cardholders as reasonably determined by either party, the parties agree that such arbitration will proceed on an individual basis but will be handled by a panel of three (3) arbitrators. Each party shall select one arbitrator, and the two party-selected arbitrators shall select the third, who shall serve as chair of the arbitral panel. That chairperson shall be a retired judge or an attorney licensed to practice law and with experience arbitrating or mediating disputes. In the event of disagreement as to whether the threshold for a three-arbitrator panel has been met, the sole arbitrator appointed in accordance with this section shall make that determination. If the arbitrator determines a three-person panel is appropriate, the arbitrator may – if selected by either party or as the chair by the two party-selected arbitrators – participate in the arbitral panel. Except as and to the extent otherwise may be required by law, the arbitration proceeding, and any award shall be confidential. This Arbitration Provision evidences a transaction in interstate commerce and therefore the Federal Arbitration Act (9 U.S.C. § 1, et seq.) applies including its procedural provisions, in all respects. This means that the Federal Arbitration Act governs, among other things, the interpretation and enforcement of the Arbitration Provision and all of its provisions, including, without limitation, the class action waiver.

Arbitrator’s Decision.

The arbitrator will issue an award within the time frame specified in the JAMS Rules. Judgment on the arbitration award may be entered in any court having jurisdiction over the proceeding. Except as otherwise required by applicable law, any damages awarded by the arbitrator must be consistent with the terms of the “Limitation of Liability” section above. The arbitrator can award on an individual basis the same damages and relief as a court (including injunctive and declaratory relief or statutory damages), and must follow the Agreement as a court would. For the avoidance of doubt, the arbitrator can award public injunctive relief if authorized by law and warranted by the individual claim(s).

Fees.

Payment of all filing, administration, and arbitrator fees will be governed by the applicable JAMS Rules, subject to any state limitations on arbitration costs. If you prevail in arbitration you may be entitled to an award of attorneys' fees and expenses, to the extent provided under applicable law. Paga will not seek, and hereby waives all rights it may have under applicable law to recover, attorneys' fees and expenses if it prevails in arbitration unless the arbitrator finds that either the substance of your Claim or the relief sought to be frivolous or brought for an improper purpose.

Survival and Severability of Arbitration Provision.

This Arbitration Provision shall survive the termination of this Agreement. With the exception of Section 15(f), if a court decides that any part of this Arbitration Provision is invalid or unenforceable, then the remaining portions of this Arbitration Provision shall nevertheless remain valid and in force. In the event that a court finds that all or any portion of Section 15(f) to be invalid or unenforceable, then the entirety of this Arbitration Provision shall be deemed void and any remaining Claim must be litigated in court pursuant to Section 15(d).

Electronic Communications

The Services are only available electronically. In order for you to receive the Services, you agree to receive all disclosures electronically pursuant to your Consent to Electronic Disclosures. If, for some reason, you cannot receive communications electronically in the future, we cannot provide the Services to you and you should close your Account and we may terminate your Account.

Privacy Policy

Our Privacy Policy, as may be amended from time to time, is incorporated into this Agreement. However, when you use our Services, or register for an account with us, we will collect personal information from you. By providing your personal information to us, you expressly agree to our collection, use, storage, and disclosure of such information as described in our Privacy Policy.

Confidentiality of Your Account

If you use the Services, you are responsible for maintaining the confidentiality of your Account and password and for restricting access to your access device (such as your mobile device or computer), and you agree to accept responsibility for all activities that occur under your account or password. If your status as a user of the Services is terminated, you will (i) stop using the Services and the Paga App and any information obtained from the Services and the Paga App, and (ii) destroy all copies of your account information, password and any information obtained from the Services. If you become aware of any unauthorized use of your account, you agree to notify us immediately at help@paga.com.

Proprietary Rights

We own and operate the Services. We own exclusively or our licensors and suppliers own all content, visual interfaces, information, graphics, design, compilation, computer code, products, software, services, text, data, contents, names, trade names, trademarks, trade dress, service marks, layout, logos, designs, images, graphics, illustrations, artwork, icons, photographs, displays, sound, music, video, animation, organization, assembly, arrangement, interfaces, databases, technology, and all intellectual property of any kind whatsoever and the selection and arrangement thereof (collectively, the “Paga Materials”). The Paga Materials are protected by U.S. copyright, trade dress, patent, and trademark laws, international conventions, and all other relevant intellectual property and proprietary rights, and applicable laws. Nothing on the Services should be construed as granting, by implication, estoppel, or otherwise, any license or right to use any of the Paga Materials displayed on the Services, without our prior written permission in each instance.

All Paga Materials on the Services and the App (as well as the organization and layout of the Services and the App) are owned and copyrighted, licensed by, or used with permission that is granted to Paga. No reproduction, distribution, or transmission of the copyrighted materials in the Services and the App are permitted without the prior written permission of Paga.

Miscellaneous

The Services are provided by:

Apposit LLC D/B/A Paga

1207 Delaware Ave #2352

Wilmington, DE 19806

For disputes over the meaning of this Agreement, other than Section 15, this Agreement is governed by the laws of Delaware, without giving effect to any principles of conflicts of law. Failure by Paga to insist upon strict enforcement of any provision of this Agreement will not be construed as a waiver of any provision or right. You may have greater rights, or some of the provisions may be prohibited, by virtue of state or federal consumer protection laws. In such a case, to such extent, the subject provisions shall not apply to you.

This Agreement, including any agreement that incorporates or has been incorporated into this Agreement, is the entire understanding and agreement between you and Paga regarding the Services. With respect to its subject matter, this Agreement supersedes any previous agreement to which you and Paga may have been bound that does not incorporate or has not been incorporated into this Agreement. This Agreement will be binding on, inure to the benefit of, and be enforceable against the parties and their respective successors and assigns. Neither the course of conduct between parties nor trade practice will act to modify any provision of the Agreement. You may not assign or transfer this Agreement or your rights hereunder, in whole or in part, by operation of law or otherwise, without our prior written consent. We may assign this Agreement or any of our rights or obligations under this Agreement at any time without notice. All rights not expressly granted herein are hereby reserved. Headings are for reference purposes only and in no way define, limit, construe or describe the scope or extent of such section.

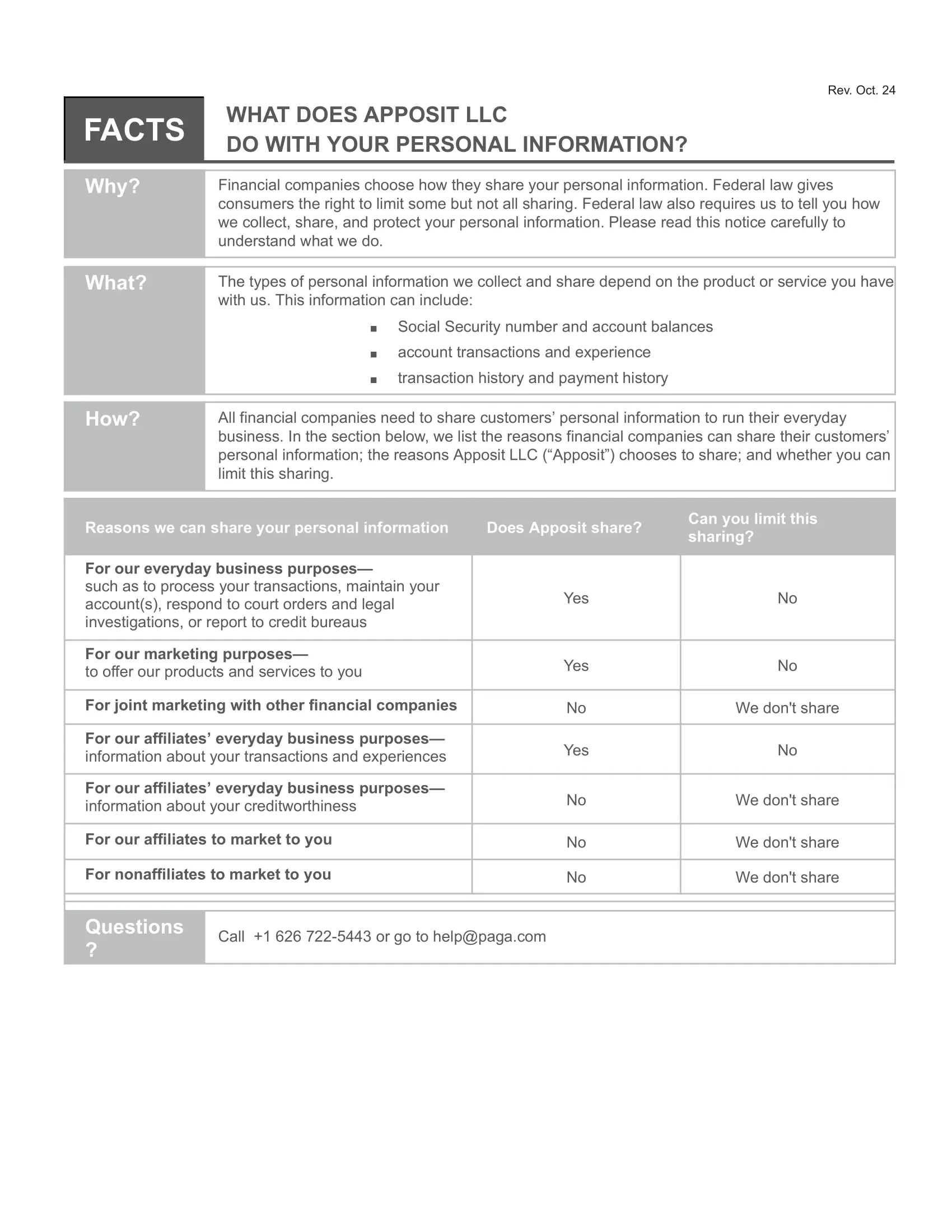

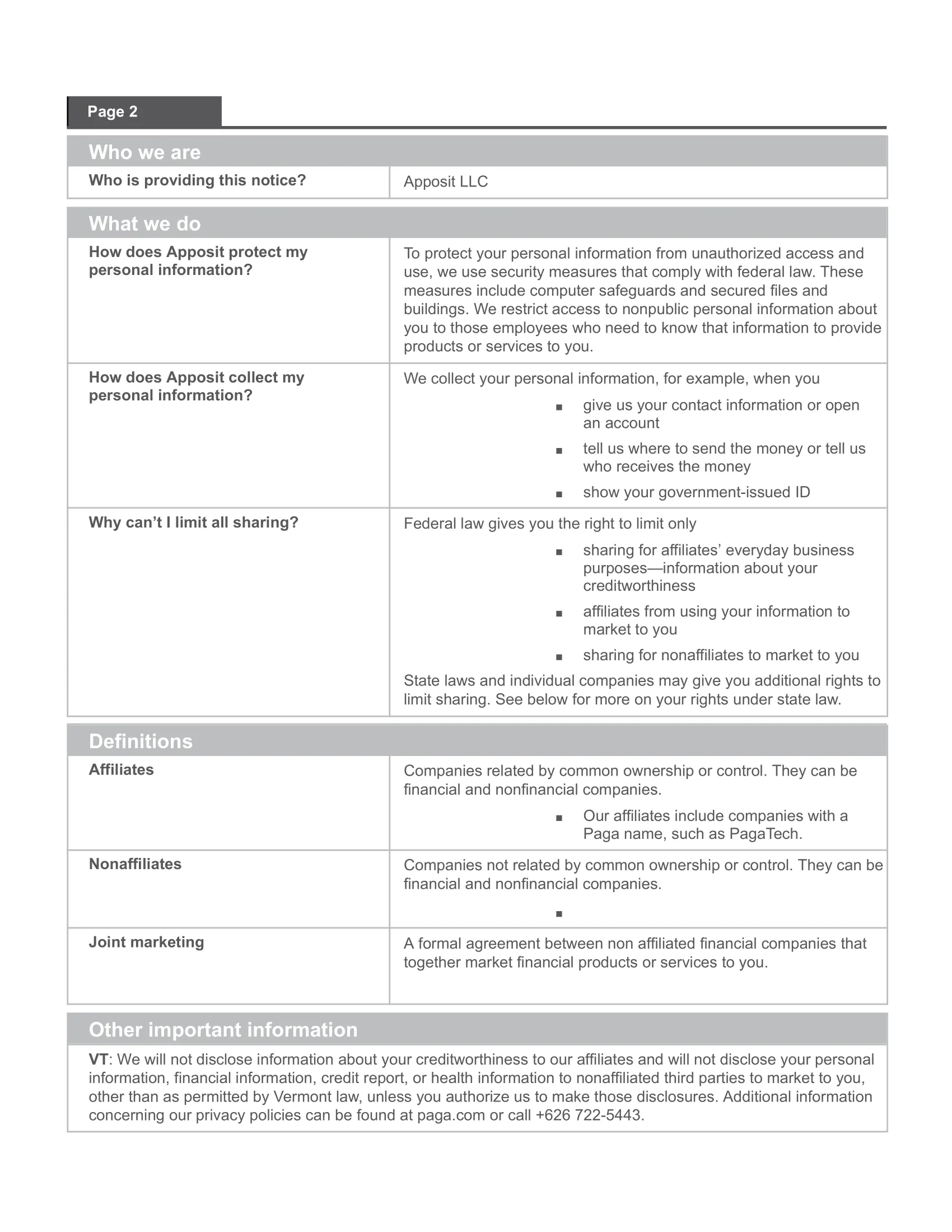

Privacy Notice

E-Sign Consent

Electronic Communications Consent

This Electronic Communication Disclosure and Agreement ("the E-Sign Consent") is a legally binding agreement between Apposit LLC D/B/A Paga and its subsidiaries, affiliates, agents and assigns (collectively, "Paga”), and you ("you," "your") regarding your use of Services offered, operated or made available by Paga or Regent Bank, including as the Services offered (collectively, the “Services”), operated or made available by Paga through its website, including www.paga.com and any subdomain, or mobile application (collectively, the “Website”). The terms “we”, “us”, and “our” refer to Paga and Regent Bank, collectively.

The Services may be delivered, administered, obtained, or accessed electronically through the Internet, email, text-messaging, and/or software applications (including applications for mobile or handheld devices). In connection with any Service, we may choose to provide certain Communications to you in electronic form and obtain your electronic signature in connection with those Communications. If you choose not to agree to this E-Sign Consent, or you withdraw your consent, you may be ineligible to use or obtain our Services.

By agreeing to this E-Sign Consent, you agree that you reviewed this E-Sign Consent and verified that you can print or save a copy of it with your records. You further give your express consent to receive, view, and electronically sign the Communications we display on any website, through any web browser, or in any software application (including any application for mobile or handheld devices), You agree that the electronic Communications we send to your designated email address may include Communications displayed in the email message, attached to it or displayed when you selected links included in the message. When a Communication is electronically displayed on your computer or your mobile or handheld device, you agree that your electronic signature for the Communication may include clicking displayed buttons, selecting displayed boxes, typing your name in a designated field or otherwise selecting an electronic facsimile signature for the field, sending an email reply to a message transmitted to your designated email address, or taking other affirmative actions described when you view an electronic Communication displayed on your computer or your mobile or handheld device. Your consent for our use of electronic Communications and signatures will be effective unless you withdraw it in the manner described below.. Communications include, as applicable:

● Any information provided to you about your inquiry or offers, including your exchange rate, fees, any adverse action we or a partner may take, and any final terms of your account;

● Any information provided to you about any product, service, or transaction you receive;

● Any terms and conditions and policies you agree to, including updates to these agreements or policies, and other authorizations you provide;

● Any documents or disclosures we or provide to you; and,

● Any other information relating to your relationship with Paga , including all documents, communications, contracts, statements, notices, authorizations, and disclosures (including federal or state tax documents, statements, forms, and schedules) arising from or relating to your use or attempted use of any Service.

We will provide these Communications to you by posting them on the Website after you log-in, and/or by emailing them to you at your registered email address. It is your responsibility to keep your registered email address up to date so that we can communicate with you electronically.

As part of your use of our Services, you are entitled by law to receive certain information “in writing”. All Communications in either electronic or paper format from us to you will be considered “in writing”. You acknowledge and agree that your consent to Communications is being provided in connection with a transaction affecting interstate commerce that is subject to federal Electronic Signatures in Global and National Commerce Act (the “Act”), and that you and we both intend that the Act apply to the fullest extent possible to validate our ability to conduct business with you by electronic means.

You have the right to request paper copies of any communication. Paper copies can be requested by calling us during our operating hours. If you request a paper copy, we reserve the right to charge you additional fees for paper copies - up to $10 per Communication. A request for a paper copy of any Communication will not be considered a withdrawal of your consent to receive Communications electronically.

In order to access and retain electronic Communications, you will need: a computer or mobile device with an Internet connection and capable of supporting the software described here; a current web browser that includes 128-bit encryption and with cookies enabled (e.g. Microsoft Edge version 9.0 and above, Firefox version 87.0 and above, Chrome version 89.0 and above, or Safari 13.0 and above); a valid email address and related software capable of receiving email through the Internet and, if you use a spam filter, capable of permitting messages from us; software that allows you to view and print or save PDF documents, such as Adobe Reader or similar software; and sufficient storage space to save past Communications or an installed printer to print them.

You confirm that you have access to the necessary equipment and software to receive and save/print our Communications to you.

You have the right to withdraw consent and may withdraw your consent to receive Communications electronically or update information needed to contact you electronically by emailing us; by calling us during our operating hours; or by writing to us via regular mail. If you withdraw your consent prior to completing your application, you will not be able to complete the application process and therefore will not be issued an account.

It is your responsibility to provide us with a valid phone number, contact, email, and other information on file with Paga and Regent Bank, and to maintain and update promptly any changes in this information. You understand and agree that if we send you an electronic Communication but you do not receive it because your valid phone number or email address or other contact information is incorrect, out of date, blocked by your service provider, or you are otherwise unable to receive electronic Communications, we will be deemed to have provided the Communication to you.

Your use of a spam filter that blocks or re-routes emails from senders not listed in your email address book may impact your ability to receive our Communications. Therefore, you must add Paga and Regent Bank to your email address book so that you will be able to receive the Communications we send to you.

You can update your contact information through the Website.

You acknowledge that we may amend this policy at any time by posting a revised version on our website. If we make a material change to this policy we will also send a notice to your registered email address.

KYC Disclosure

USA Patriot Act Notice

To help the government fight the funding of terrorism and money laundering activities, Federal law requires all financial institutions to obtain, verify, and record information that identifies each person who opens an account. What this means for you: When you open an account, we will ask for your name, address, date of birth, and other information that will allow us to identify you. We may also ask to see your driver’s license or other identifying documents.

Biometric Notice and Consent

Apposit LLC and its affiliates (“Apposit”) and its service providers, may collect, obtain, retain, possess, capture, receive, store, create, use or otherwise process information about your facial features which may qualify as biometric identifiers or biometric information under applicable law (collectively, “Biometric Data”) when you interact with certain of our products and services (collectively, our “Services”). This Notice explains the purposes for which this information is collected or stored, the length of time that is retained, and the reasons for which it may be disclose to others. For questions about this notice, please email us at help@paga.com.

Apposit uses a third party service provider, Smile Identity Inc. (“Smile ID”), to collect and analyze images of you and from identity documents that you provide, as well as device information, for use in identification and authentication. This process may include measurements of biometric identifiers, such as facial geometry, and further may result in biometric information derived from such facial geometry. This collection and processing is performed by Smile ID, and Apposit generally does not receive, possess, process, store, control, or have access to any Biometric Data during this process; however, under certain laws it may be deemed to “possess” or otherwise “process” such information through its relationship with Smile ID. For more information about Smile ID’s data collection, processing, and retention practices, please review the Smile Data Processing Terms.

Unless otherwise permitted or required by law, Apposit will permanently delete information derived from Smile ID’s facial identification features upon the occurrence of either of the following, whichever occurs first:

When the initial purpose for collecting or obtaining the Biometric Data has been satisfied, such as when you close your account with us; or,

within 3 years of your last interaction with Apposit or our Services.

Apposit will retain, use, and share other information about you in accordance with its Privacy Policies, as applicable.

By using our Services, you expressly consent to the collection, use, storage, disclosure, and other processing of your Biometric Data for the purposes and durations described above.

Consumer Checking Account Agreement

IMPORTANT – PLEASE READ CAREFULLY. THIS AGREEMENT (AS DEFINED BELOW) CONTAINS AN ARBITRATION PROVISION (IN SECTION L BELOW) REQUIRING ALL CLAIMS TO BE RESOLVED BY WAY OF BINDING ARBITRATION.

TABLE OF CONTENTS:

A. Introduction; Account Opening Disclosures.

B. Consent to Use Electronic Signatures, Communications and Statements

C. The Account, Generally

D. Interest Information

E. Deposits to the Account

F. Withdrawals from the Account

G. Funds Availability

H. Electronic Funds Transfer Disclosures

I. Wire Transfer Services

J. Additional Information Regarding Card

K. Instant Payments

L. Miscellaneous

Introduction; Account Opening Disclosures.

This Consumer Checking Account Agreement (this “Agreement”) is between you and Regent Bank (“Bank”), a member of the Federal Deposit Insurance Corporation (“FDIC”), governing the deposit account (the “Account”) provided by Bank and the Visa® Debit Card (“Card”) issued by Bank pursuant to a license by Visa Incorporated. As used in this Agreement the words “we”, “our”, and “us” refer to Bank, our successors, affiliates, or assignees, and the words “you” and “your” refer to you, the individual, and the Account holder and Card holder, who agrees to be bound by this Agreement, as well as anyone else with the authority to deposit, withdraw, or exercise control over the funds in the Account and anyone else that you authorize to use a Card.

Access to your Account and the services under this Agreement are available only through the website and/or phone application (collectively, the “Paga App”) of Apposit LLC D/B/A Paga (“Paga” or the “Platform”), our services provider that services parts of your Account and Card.

You may only use the Account and Card for personal, family or household purposes, and we may close the Account and Card if we determine either is being used for business purposes. This Agreement includes the Privacy Policy described in Section C.

Access to your Account and the services offered under this Agreement shall be accessed through the Paga App unless we notify you otherwise. YOU AUTHORIZE BANK TO ACCEPT ALL INSTRUCTIONS PROVIDED THROUGH THE PAGA APP.

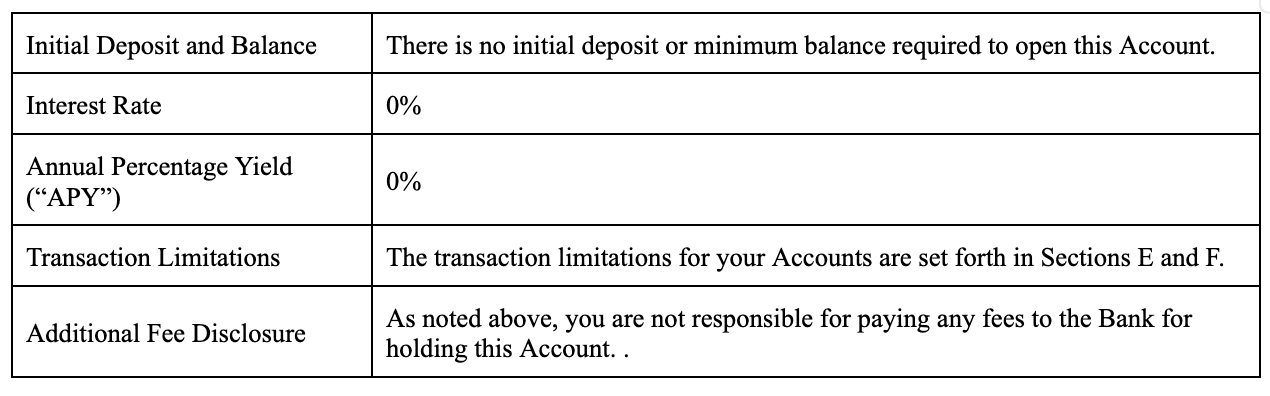

Truth In Savings Disclosures

The interest rate and APY is correct as of today’s date, but is subject to change at any time in our discretion, as further described in Section D.

B. Consent to Use Electronic Signatures, Communications and Statements.

Introduction. In order to open an Account, you must consent to the use of electronic signatures and electronic records for all transactions with us and for all agreements, disclosures, notices and other Communications (as defined below) relating to those transactions. Once you have given your consent, we may deliver or make any of the documents or Communications available to you by posting them in the Paga App and sending you an email notification when they become available.

Your Legal Rights. Certain laws require us to provide specific information to you in writing, which means you have a right to receive that information on paper. We may provide such information to you electronically if we first obtain your consent to receive the information electronically. Your consent will also apply to any other person named on your Account, product or service, subject to applicable law.

Your Consent to Electronic Signatures. By accepting this Agreement, you understand that: (i) electronically signing and submitting any document(s) to Bank legally binds you in the same manner as if you had signed in a non-electronic form, and (ii) the electronically-stored copy of your signature, any written instruction or authorization and any other document provided to you by Bank is considered to be a true, accurate and complete record, and legally enforceable in any proceeding to the same extent as if such documents were originally generated and maintained in printed form. By accepting this Agreement, you also acknowledge and agree that you have read, understand and agree to all the terms of this Section B, can access the Communications in electronic form, affirmatively consent to the use of electronic signatures and electronic records, and have an active email account. You agree not to contest the admissibility or enforceability of Bank’s electronically stored copy of this Agreement and any other documents.

Your Consent to Electronic Communications. To the fullest extent permitted by law, this Agreement, account statements, notices, legal and rate disclosures for your Account, updates and changes to this Agreement, or other service agreements and other communications (collectively, “Communications”) from us to you regarding your Account(s) and related services with us may be provided to you electronically, and you consent and agree to receive all those communications in an electronic form. Electronic Communications may be posted on the pages within the Paga App and/or delivered to your email address. You may print a paper copy of or download any electronic Communication and retain it for your records. All Communications in electronic format will be considered to be “in writing,” and to have been received on the day of posting, whether or not you have received or retrieved the Communication. We reserve the right to provide Communications in paper format. You may withdraw your consent to electronic Communications by contacting us. A withdrawal of your consent will not become effective until we have received and have had a reasonable period of time to implement it. A withdrawal of your consent does not affect the legal effectiveness, validity or enforceability of any transactions, electronic signatures or electronic records of any Communication entered into, provided or made available before that withdrawal becomes effective. Your consent to receive Communications electronically is valid until your revocation of consent becomes effective. If you revoke your consent to receive Communications electronically, we may terminate the Account and related services. You accept all liability for any losses, cost, damages and expenses resulting from such termination to the extent permitted by law.

Your Review of Communications. Please review promptly all Communications we deliver or make available to you. If Communications are mailed to you, they will be delivered to you at the postal address shown in our records. If Communications are sent to you electronically, they will be delivered to you at the email address shown in our records or made available to you on the Paga App. We will retain printable versions of your Account statements for five (5) years or longer periods as may be required by applicable law. You agree to give us and Paga notice of any change of your postal or email address. If you fail to update or change an incorrect email address or other contact information, you understand and agree that any Communication shall nevertheless be deemed to have been provided to you if it was made available to you in electronic form in the Paga App or you were provided email notification of its availability.

Reporting to You (Statements); Errors and Disputes. Statements will be made available to you to view and/or print on the Paga App. We will send an email notification when the statements are available online on a periodic basis at approximately monthly intervals. The Account statement will describe each credit or debit), date of credit or debit. You may view your statement by logging into Paga’s mobile application. Electronically delivered statements will provide all information that would be available in paper statements. Account statements will be considered to be correct unless you notify us, through Paga, of any errors within sixty (60) days of becoming available. Carefully review your statement each statement cycle and notify us of any errors within sixty (60) days of your statement becoming available. Bank will not be liable to you for any error that you do not report to Bank within that period of sixty (60) days. If you think your statement is wrong or if you need more information about a transaction listed on it, please contact us via Paga, at the customer service contact information set forth in Section L below. In making such communication, you need to tell us: (i) your name and Account number; (ii) why you believe there is an error and the dollar amount involved; and (iii) approximately when the error took place. If you need more information about our error resolution process, contact customer service (at the customer service contact information set forth in Section L below). This paragraph is subject to Section H, and in the event of any conflict between this paragraph and Section H regarding electronic fund transfers, Section H will apply.

Hardware and Software Requirements. To access and retain electronic records of the Communications, you must use computer hardware and software that meets the following requirements: a Current Version (defined below) of an Internet browser we support; a connection to the Internet; an email account and related software capable of receiving email through the Internet and, if you use a spam filter, capable of permitting messages from us; a Current Version of a program that reads and displays PDF files (such as Adobe Acrobat Reader); and a computer or mobile device with an operating system capable of supporting all of the above. By "Current Version," we mean a version of the software that we support and that is currently being supported by its publisher. To print or download electronic records of Communications, you must have a connected printer or sufficient space on a long-term storage device.

C. The Account, Generally.

Eligibility. The Account is available to consumers who are citizens, permanent residents or non-permanent resident aliens in the United States on a valid long-term visa, at least eighteen (18) years of age, and with a valid Social Security Number or a Tax Identification Number. The Account is also available to non-US-residents in approved jurisdictions where the Paga App is available, upon Bank approval, if the equivalent of a Social Security Number or a Tax Identification Number is obtained and verified in any country where Paga App users are permitted to register. All deposits to and withdrawals from the Account must be in U.S. dollars. Paga or another third-party may provide you with a means of converting foreign currency into U.S. dollars for deposit. You must agree to accept electronic, rather than paper statements, as provided above. This means: (i) you must keep us supplied with your valid email address; and (ii) you must agree to accept electronic delivery of all account communications (such as end-of-year tax forms and electronic statements). If you do not do so, you may not open an Account. If you withdraw your consent, we may close your Account.

Important Information about Procedures for Opening a New Account. To help the government fight the funding of terrorism and money laundering activities, Federal law requires all financial institutions to obtain, verify, and record information that identifies each person who opens an Account. What this means for you: When you open an Account, we will ask for your name, address, date of birth, and other information that will allow us to identify you. We may also ask to see a copy of your driver’s license or other identifying documents.

Account. The Account consists of an interest-bearing checking account used to hold your deposits and make payments and transfers to and from the Account. You will access your Account via the Paga App. If enabled by us, the Account may include the use of a Card, which is linked to the Account for purposes of making payments and transfers to third parties. Additional information relating to use of the Card is set forth in Section J.

Password Security. You are responsible for maintaining adequate security and control of any and all user IDs, passwords, hints, personal identification numbers (“PINs”), or any other codes that you use to access the Account or Card. If you permit any other person(s), including any data aggregation service providers, to access or use your user IDs, passwords, hints, PINs, or any other codes that you use to access the Account or Card, you are responsible for any transactions and activities performed from your Account or Card and for any use of your personal and account information by such person(s) to the maximum extent permitted by law. Do not discuss, compare, or share information about your account number or password unless you are willing to give them full use of your money. Any loss or compromise of the foregoing information and/or your personal information may result in unauthorized access to your Account or Card by third parties and the loss or theft of any funds held in your Account and any associated accounts. Electronic withdrawals are processed by automated methods, and anyone who obtains your Account number, Card or access device could use it to withdraw money from your Account, with or without your permission. You are responsible for keeping your email address and telephone number up to date in order to receive any notices or alerts that we may send you. We assume no responsibility for any loss that you may sustain due to compromise of your account login credentials due to no fault of Bank or the Company and/or your failure to follow or act on any notices or alerts that we may send to you, except as required by law, including 12 C.F.R. § 1005.6. You agree to promptly review all Account and transaction records and other Communications that we make available to you and to promptly report any discrepancy to us.

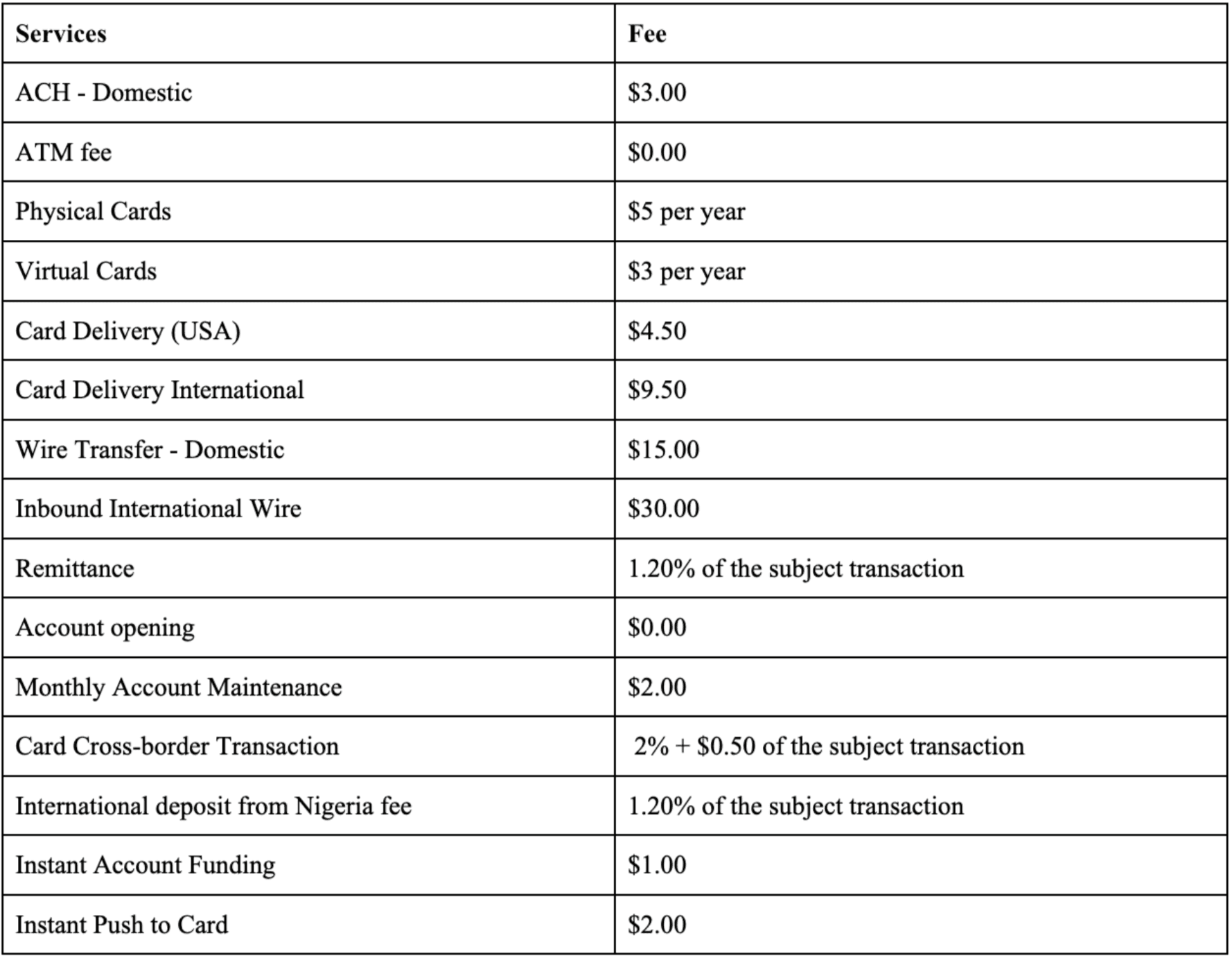

Account Maintenance Fee . You agree to pay us a two dollar ($2) account maintenance fee on the last business day of each calendar month for use of the Account.

Account Titling and Ownership. The Account may be owned and titled in the name of one (1) person who shall solely retain the right to direct the deposit or transfer of funds, or jointly. The Account cannot be owned or titled jointly by an organization, as Payable on Death (“POD”) or “In Trust For” (“ITF”).

Power of Attorney. You may wish to appoint a designated attorney-in-fact to conduct transactions on your behalf (in such capacity, your “Agent”). We have no duty or agreement whatsoever to monitor or insure that the acts of your Agent are for your benefit. We will not be required to follow the instructions of your Agent unless you have furnished us a power of attorney in a form or under circumstances acceptable to us. Unless you revoke it, a power of attorney continues until your death or the death of the person given the power. If the power of attorney is not “durable,” it is also revoked when you become incompetent. We may require your Agent to sign an affidavit stating that the power of attorney presented to us is a true copy and that, to the best of your Agent’s knowledge, you are alive and competent and that the relevant powers delegated to your Agent have not been amended or terminated. We may continue to honor the transactions of your Agent until: (1) we have received written notice of the termination of the authority or notice of your death, and (2) we have a reasonable opportunity to act on that notice. You agree not to hold us responsible for any loss or damage you may incur as a result of our following instructions given by an Agent acting under a valid power of attorney.

Privacy Policy. Bank’s privacy policy is available at https://www.regent.bank/privacy-policy/ and https://www.regent.bank/online-privacy-policy/ . By entering into this Agreement, you acknowledge that you have read and accepted the Privacy Policy.

Location of the Account. Your Account is established in the State of Oklahoma.

Internet Gambling; Illegal Transactions. You agree not to use your Account, Card or our services for unlawful online gambling or any illegal activity. We may refuse to process any transaction that we believe may violate the terms of this Agreement or applicable law. You acknowledge and agree that we have no obligation to monitor, review or evaluate the legality of your transactions and Account activity. You agree that using Bank or Company services or your Account or Card for illegal activity will be deemed an action of default and/or breach of contract and, in such event, our services and/or your Account may be terminated at our discretion. You further agree that should illegal use occur, you waive any right to sue us for such illegal use or any activity directly or indirectly related to it, and you agree to indemnify and hold us harmless from any suits, legal action, or liability directly resulting from such illegal use. To the fullest extent permitted by law, you agree to pay for any transaction that you authorized, even if that transaction is determined to be illegal.

Freezes, Blocking or Closing Accounts Due to Irregular or Unlawful Activities. You agree that if Bank or the Company suspects that any irregular, unauthorized, or unlawful activity may be occurring in connection with your Account or Card, Bank or the Company may “freeze” or place a hold on the balance in the Account pending an investigation of such activities. If the Bank freezes your Account, Bank will give any notice required under the circumstances by the laws governing the Account. If Bank’s investigation confirms Bank’s suspicions of irregular, unauthorized, or unlawful activity then, notwithstanding anything to the contrary in this Agreement, Bank may immediately close your Account and Card, and may also close any or all other accounts, if necessary, to comply with applicable law. You agree that the Bank may also freeze, block, or close your Account as necessary in order to comply with regulations issued by the United States Department of Treasury’s Office of Foreign Assets Control (“OFAC”).

D. Interest Information.

Which Accounts Bear Interest. Your Account will bear interest as described in this Section D.

Rate Information. The initial interest rate and APY for the Account appear in the Account Opening Disclosures. This is a variable rate account. We may, at our discretion, change the interest rate and APY for your Account at any time; this may be changed daily. Paga will notify you of any change in the interest rate and APY for your Account by posting the new interest rate on the Paga App.

Accrual of Interest. Interest begins to accrue no later than the business day the deposit is credited to your Account. Interest will be compounded daily and credited to your Account on a monthly basis. Account interest is calculated using the daily balance calculation method. This method applies a daily periodic rate to the principal balance in the Account each day. There are no minimum or maximum balance restrictions on your Account.

Forfeit of Uncredited Interest. If you close your Account after interest has accrued but before it is credited to your Account, you will forfeit that interest, and it will not be credited to your Account.

E. Deposits to your Account.

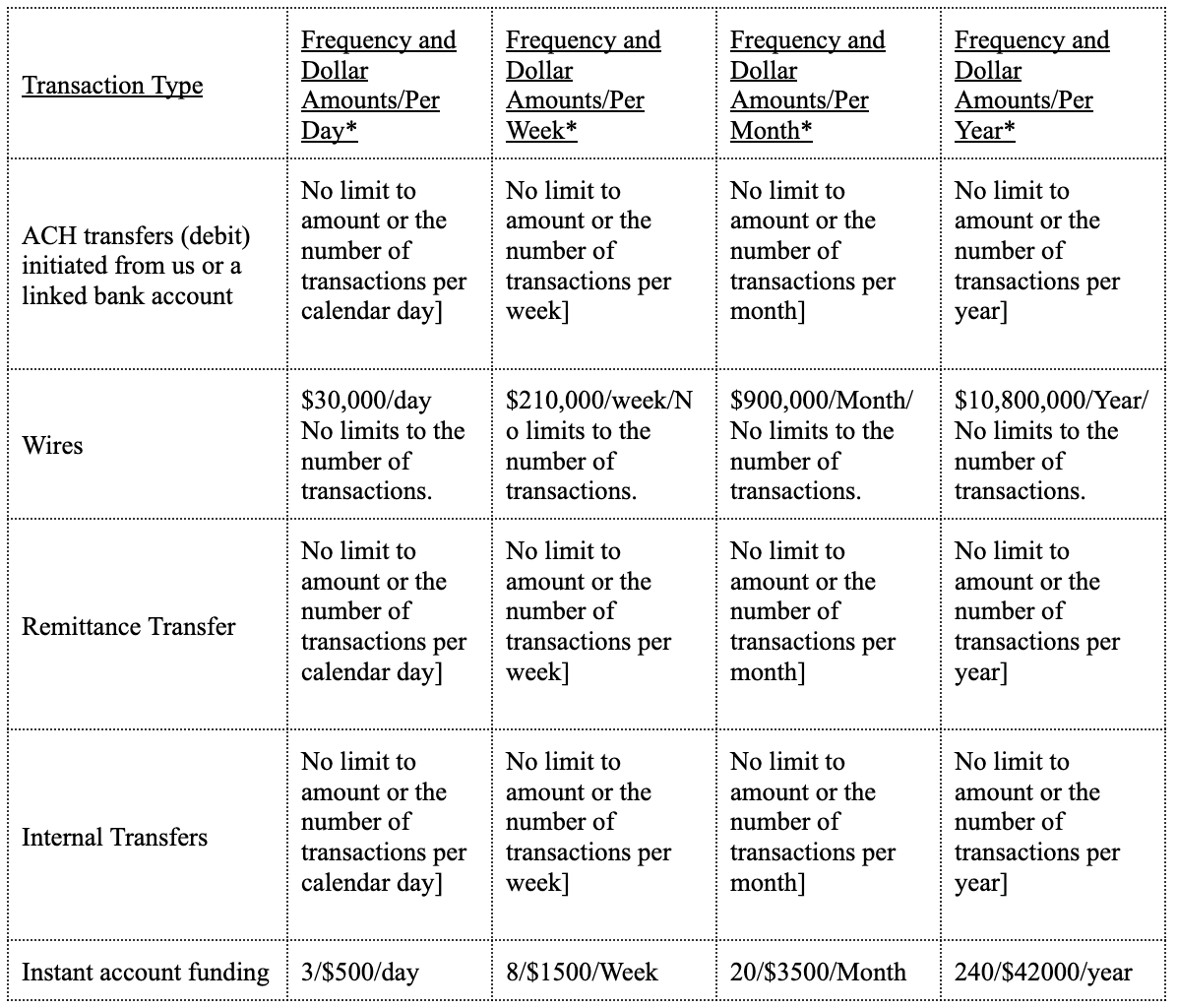

Deposits to the Account. You can make deposits into your Account using any of these methods:

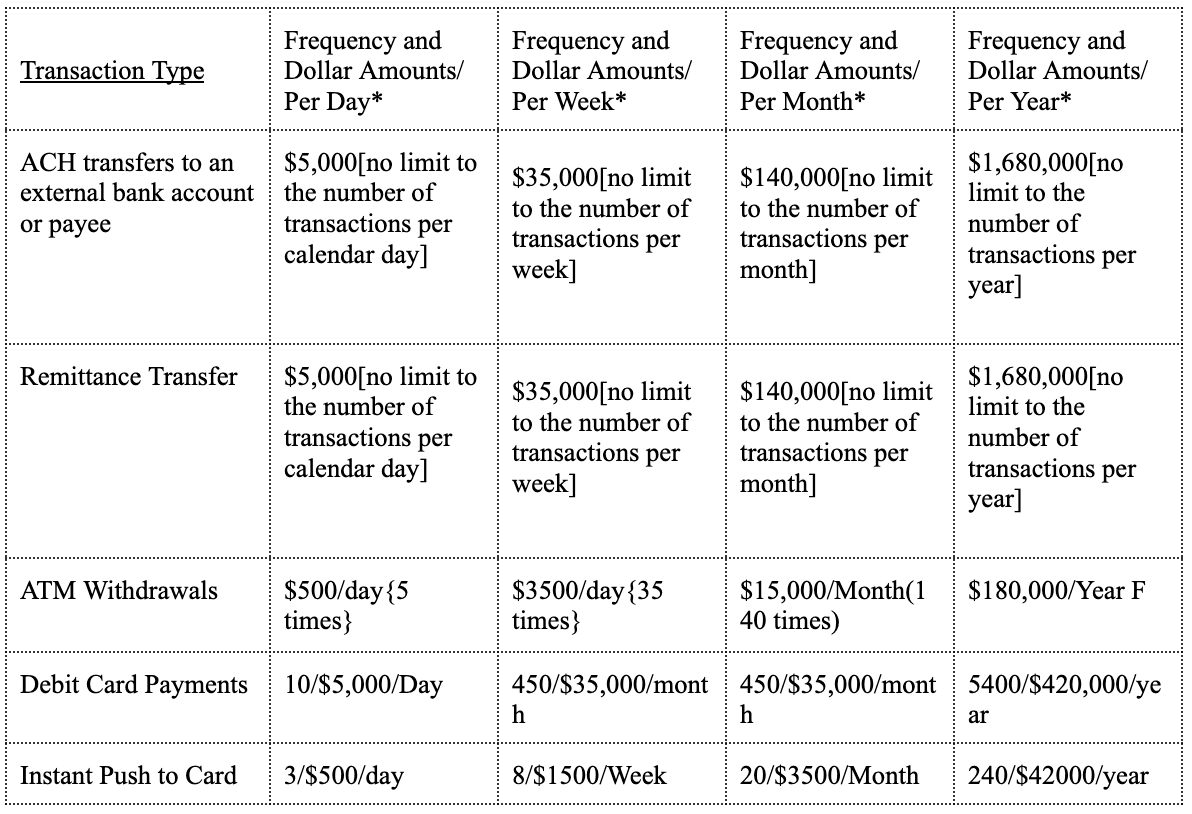

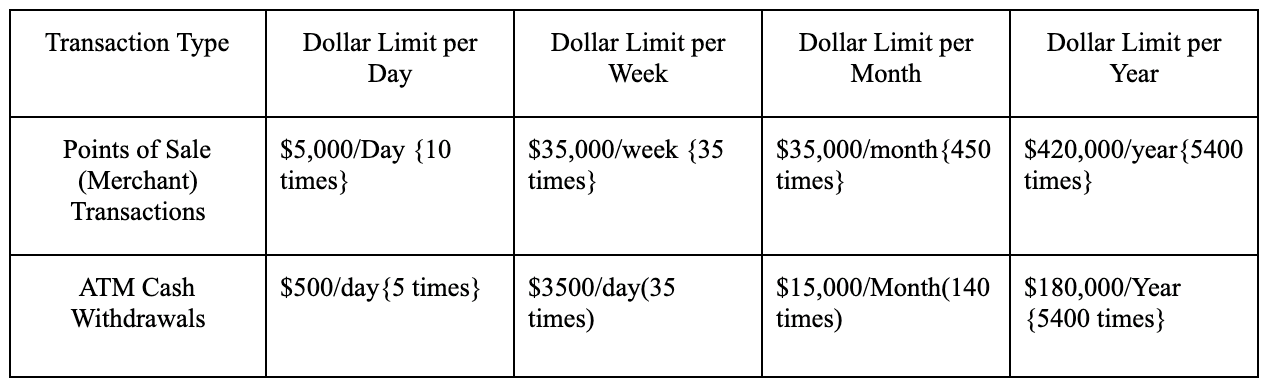

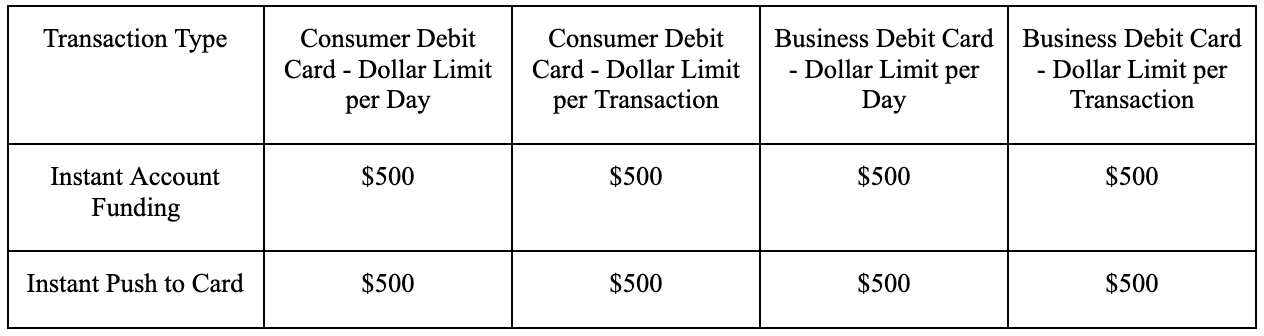

* The limits included here are the highest limits allowed for transactions. However, we reserve the right to allow you to transact higher volume than the limits defined herein at any time without prior notice. In certain cases, for security reasons, we may lower your limits upon notice to you at the time you attempt to initiate a transaction. Limits for Instant Account Funding are described in Section K below.

Linking Bank Accounts. You may link an account with us or an external account at a third-party financial institution for online transfers between your linked account(s) and your Account. You may link your external account(s) with your Account by (i) logging into your financial institution on the Paga App, or (ii) by providing the account and routing details for the external account and verifying the two (2) micro deposits we send to your external account the next business day. We may also verify your control of the external account by requiring you to submit proof of ownership of the external account(s). We may decline the use of any external account at our discretion, including if we believe that such use may present a risk to you or us. By linking your external account to your Account, and by subsequently logging into your linked account(s) through the Paga App, you authorize us to view your account history and profile, including, but not limited to, your account and routing details, authentication details, balance, transaction history, contact information, and other related information made available by such external financial institution; and you understand this information may be used to transact on your behalf and perform other services subject to our Privacy Policy and the Privacy Policy of the Company. When adding an external account, you represent and warrant that you are the owner of, and have the right to access, use and authorize us to use the external account for information and funds transfer purposes. If any of your linked accounts has a joint account holder, you represent and warrant that the joint account holder has consented for you to represent both you and them, and to use the external account with the Paga services. If you do not have such consent, you should not use that external account, and we will terminate your use of the linking service if we are notified of such a situation. If you close any of your external accounts, you are responsible for removing it as an account eligible for the linking service to avoid any transaction failure and possible charges related to a failed transaction. We are not responsible for any acts or omissions by the external financial institution or other provider of any linked external bank account, including, without limitation, any modification, interruption, or discontinuance of any linked external bank account by such financial institution, service provider or Paga.

Direct Deposits. If enabled by us for your Account, your Account number and bank routing number may be used for the purpose of initiating direct deposits to your Account. The Account number and recipient’s name on any direct deposit we receive must match your name. Any direct deposit received in a name other than the name registered to the Account will be returned to the originator. If your Account number changes you must immediately notify your employer or any other payors. You must provide them with the new Account number to ensure that your direct deposit activity continues uninterrupted. If you have arranged to have direct deposits made to your Account at least once every sixty (60) days from the same person or company, you can contact us via Paga at the customer service contact information set forth in Section L below to find out whether or not the deposit has been made.

Account Funding with Cards. If enabled by us for your Account, you may fund your Account with your debit card from an outside financial institution. To fund your Account using a debit card you must have a valid debit card issued by a U.S.-based bank or financial institution bearing the Visa, MasterCard or Discover logo. If enabled by us for your Account, you may use one of those debit cards to fund your Account in Instant Account Funding transactions, which are further described in Section K below.

You may not use prepaid cards or gift cards with your Account. Please keep your card account information current. If your card account number changes or your card expiration date changes, we may acquire that information from our financial services partner and update your account accordingly. You may dispute a payment made with your card issuer if you used a debit card to fund your payment. Your rights with respect to the card issuer may be broader than those available under this Agreement.

Wire Transfers. If enabled by us for your Account, you may fund your Account with a wire transfer. When we accept a wire transfer payment order instructing payment to you or to your Account, we will notify you of our receipt of payment by indicating the amount in your Account statement. Your Account statement will be the only notice of receipt which we will provide you, and no interest will be paid on wire transfer payments deposited into your account unless the account otherwise pays interest.

No Deposits in Cash or Paper Checks. Bank will not accept deposits in cash or paper check. We are not liable for any deposits (including cash) lost in the mail, lost in transit, or not received by us. We do not accept (i) deposits in cash, cashier’s checks or money order or (ii) deposits of any type of check via mail. If we receive any of those instruments by mail, we will return it to the address we have for you on file. Only deposits made in accordance with the terms of this Agreement will be accepted.

Our Right to Charge Back Deposited Checks or Electronic Transfers. If you receive an electronic transfer as provided in this Agreement and (i) the paying bank returns it to us unpaid; (ii) the paying bank demands that we repay them because the electronic transfer was fraudulent; or (iii) the sending bank or the originator of an item demands that we return the item because it was unauthorized, sent to the wrong account number or procured by fraud, we may pay the return or demand, and subtract the funds from your Account, even if the balance in your Account is not sufficient to cover the amount we subtract or hold, causing an overdraft. If we have reason to believe that any of the events in the previous sentence have occurred or may occur or that the item should not have been paid or may not be paid for any other reason, we may place a hold on the funds or move them to a non-customer account until we determine who is entitled to them.

Right to Reject Any Deposit. We may refuse any deposit, with or without cause. We are under no obligation to accept any item, wire, electronic funds transfer, or other transaction for deposit to your Account or for collection, and we may refuse to give value for any such transaction. We may restrict access to any deposit credited to your account that violates any laws of the United States, including those giving rise to OFAC sanctions.

F. Withdrawals from the Account.

In addition to those withdrawals using your Card (if applicable) described in Section J below and Instant Push to Card Transactions (if applicable) described in Section L below, you can make withdrawals from your Account using any of these methods (if enabled by us):

* The limits included here are the highest limits allowed for transactions. However, we reserve the right to allow you to transact higher volume than the limits defined herein at any time without prior notice. In certain cases, for security reasons, we may lower your limits upon notice to you at the time you attempt to initiate a transaction. Limits for Instant Push to Card are described in Section K below.

Instant Push to Card. If enabled by Platform, you may be able to send payments from your Account in Instant Push to Card transactions, which are further described in Section K below.

Wire Transfers. If enabled by us for your Account, you may make payments or withdrawals from your Account via a wire transfer payment order. Payment orders will not be accepted until executed by us. We reserve the right to refuse to accept any payment order.

No Overdrafts. You are not permitted to overdraw your Account. If the available balance in your Account is at any time not sufficient to cover any payment or withdrawal you have authorized, we may refuse to process the payment or withdrawal. If your Account balance becomes negative for any reason, you must make a deposit immediately to cover the negative balance. If your Account has a negative balance of (i) $50 or more, it will be closed immediately and (ii) less than $0 for 4 consecutive months will be closed. If you fail to pay the amount of any overdraft, we reserve the right to refer your overdrawn Account to an attorney for collection, and you agree to pay all reasonable expenses, including, but not limited to, reasonable attorney’s fees and court costs, incurred by us as a result of your Account being overdrawn.